The FIFO method, or First In, First Out, is an asset management and valuation method in which the assets produced or acquired should be sold, used, or disposed of first.

FIFO makes the cost flow assumption that the oldest inventory’s costs are included in the income statement’s cost of goods sold (or COGS), while the remaining inventory assets are matched to the asset that has been produced or acquired most recently.

What FIFO Means in Practice

The FIFO method is used for cost flow assumption purposes. In manufacturing, as items progress through the development stages and goods are sold as finished inventory items, the associated costs must be recognized as an expense. According to FIFO, the cost of goods that have been purchased first will be recognized first.

As economic situations change due to an inflationary market or rising costs, the FIFO method assigns the oldest inventory costs to the cost of goods sold. As such, the oldest costs will be priced lower than the most recent costs purchased at the new, inflated prices. As the expense is lower, a higher gross profit is recognized, and the ending inventory balance is inflated.

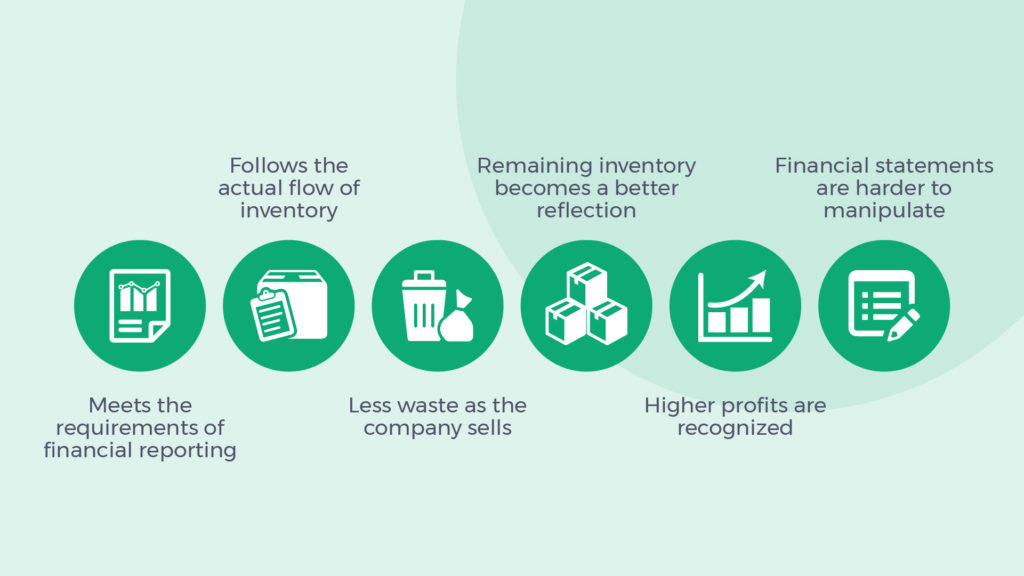

What Are The Benefits of using the FIFO Method?

Here are just some of the benefits of using the FIFO method:

- The FIFO method ranks among generally accepted accounting principles (GAAP) and meets the requirements of most international financial reporting standards;

- FIFO follows the actual flow of inventory (older inventory is sold first), which allows for a more accurate method of accounting;

- There is less waste as the company sells its older inventory first;

- Remaining inventory becomes a better reflection of market value;

- Higher profits are recognized;

- Financial statements are harder to manipulate.

By using this accounting method, the company gains a more accurate picture of its business. On the downside, the gap between costs and profits is wider (compared to the gap when using the LIFO method, which we’ll explore at a later stage).

Businesses should also be careful not to overstate profits as production costs rise, and those numbers are used in their cost of goods calculation. This may mean that tax authorities recognize more profit, leading to higher taxes.

How To Calculate FIFO

To calculate COGS using the FIFO method, one has to calculate the cost of your oldest inventory and multiply that cost by the amount of inventory that has been sold. The inventory sold refers to the cost of goods purchased (to resell) or the cost of goods produced (including all overheads).

The prices paid by a company for its inventory will fluctuate, and fluctuating costs should be taken into account as well.

For example, a business buys 100 units of an item. Twenty of the units were bought for $10 each, thirty for $12 each, and the remaining 50 units for $15 each. The company cannot assign the $10 cost to all of their units, only the 20 bought at that price.

When selling, only the goods sold can form part of the equation. The unsold goods can’t be applied to the COGS calculation.

This is what the calculation will look like in practice: John owns a company that manufactures bike helmets. He calculates the cost of goods sold for the previous year using the FIFO method.

Let’s use the same numbers from the previous example: John buys 20 units for $10 each in March, 30 in April for $12, and then 50 for $15 in June. He sells 60 of the units.

To calculate the cost of goods sold, John completes the calculation as follows:

20 x $10 = $200

30 x $12 = $360

10 x $15 = $150

The total cost of goods sold is $710 and the remaining unsold units (40 units) are considered inventory, held at their cost: $15/unit in this case.

LIFO and Other Inventory Valuation Methods

Some companies prefer to use the LIFO method, or the last in, first out method. The last item that has been purchased is the first item sold. In economies with high inflation, this may result in a deflated net income cost and lower ending balances compared to FIFO.

Alternatively, companies could use average cost inventory. It assigns the same cost to every item and results in net income and ending inventory balances between FIFO and LIFO. This is especially present in companies that don’t have real-time data tracking implemented.

Specific inventory tracing is another option; it’s only used when the components attributable to a finished product are known.

When Should You Use FIFO?

Businesses in the United States can use either the FIFO or the LIFO method when calculating the cost of goods sold. Both methods are legal, but the LIFO method is considered far less transparent and easier to manipulate.

Corporate taxes are generally cheaper under the LIFO method, but reduced profits make a company less attractive to investors. The value of the remaining inventory will also be understated as the business uses the older costs to acquire or manufacture the product to make their calculation.

Most investors and banking institutions value FIFO for its simplicity, accuracy, and transparency. It also makes a company’s financial statements more attractive to its investors because higher profits are declared.

Outside of the US, many countries (including Canada) are required to use the FIFO method as the default for keeping track of inventory, which makes it more popular.

Key Takeaways

FIFO is popular because it follows the natural flow of the company’s inventory by considering the cost of the oldest inventory items before the newest inventory items during cost calculations. It’s not mandatory for businesses to use FIFO in the U.S., but it’s preferred over methods like LIFO.

Using the FIFO method means declaring more profit, which leads to less waste and greater accuracy in bookkeeping.

Of course, these issues are complex, and companies should consult their accountants before making any decisions related to FIFO or any other inventory valuation method. With 10X ERP’s real-time inventory tracking, your business can utilize either method and confidently know your COGS and Inventory up to the second.