Your balance sheet is one of the most important financial statements you’ll ever use. It presents a clear and critical insight into the financial health of your business. It’s used by potential investors that want to evaluate whether or not to invest in a company, business owners that want to craft more effective business strategies, or internal departments that want to optimize and reach shared organizational goals.

Understanding how to read and interpret balance sheets is critically important, whether you’re a business owner or investor. In this article, we’ll share a balance sheet example and show you how to read this important financial statement.

Why Is The Balance Sheet Important?

Balance sheets provide a summary of the company’s financial health at a given point in time. It’s broken down into assets, liabilities, and shareholders’ equity. The purpose of balance sheets will vary depending on who is reviewing them.

A business leader or owner views their balance sheet to determine whether they are succeeding or failing in specific areas. After reviewing, they may shift their policies, double down on sales efforts, or reduce overheads in response.

Auditors use balance sheets to determine whether or not a company is compliant with reporting laws it’s obligated to. Red flags on a balance sheet will require further investigation.

An investor may look at the balance sheet to determine what resources are available and how they are financed. They’ll use the information on your balance sheet to calculate metrics such as your liquidity, profitability, and debt obligations. Based on this information, an investor can determine whether or not it’s wise to invest in the company judging by how much financial risk it poses.

Understanding the Balance Sheet Equation

The information on your balance sheet is usually organized according to the so-called balance sheet equation, expressed as follows:

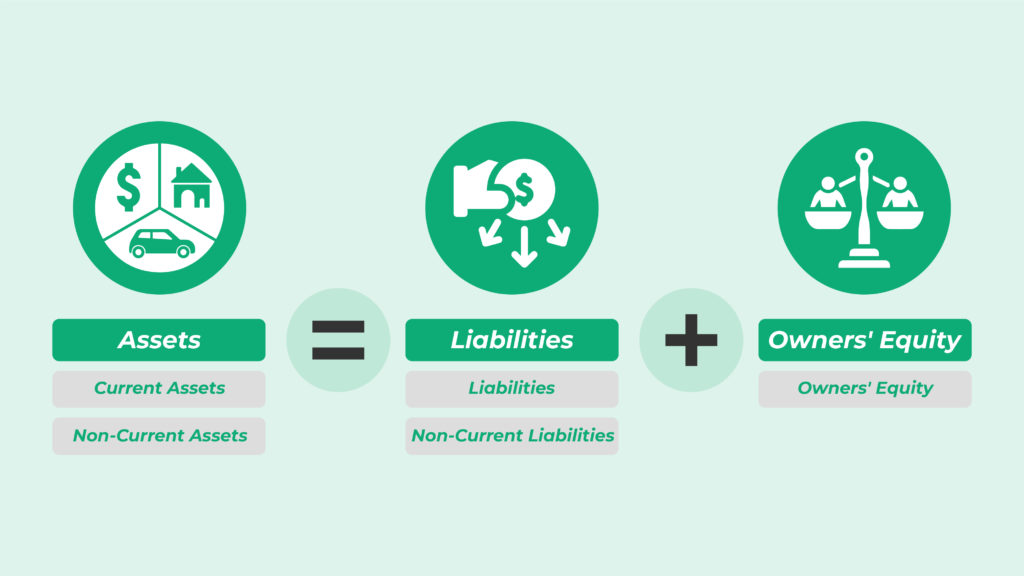

Assets = Liabilities + Owners’ Equity

This isn’t the only way to organize your information, but it’s the one most commonly found and presented in financial statements.

Balance sheets should always balance. In other words, assets should always equal liabilities plus owner’s equity, owner’s equity should always equal assets minus liability, and liabilities should equal assets minus owner’s equity.

If your balance sheet doesn’t balance, chances are there is missing or incomplete data that needs to be accounted for.

We’ll use a free example of a balance sheet, courtesy of Wise.com, to explain in more detail.

Assets

Assets are defined as anything that the company owns. The item must hold inherent, quantifiable value to be considered an asset.

Tangible assets include items such as machinery, property, raw materials, and inventory. Intangible assets include items like patents, royalties, and intellectual property. Assets are tallied as positives (+) in a balance sheet and then divided into two categories: current and non-current.

Current Assets

Current assets refer to anything a company will convert into cash or expects to convert into cash within a year, including cash and cash equivalents, prepaid expenses, marketable securities (including cryptocurrencies), inventory, accounts receivable, etc.

Non-Current Assets

Non-current assets include long-term investments that aren’t expected to convert into cash in the short term, such as land, patents, trademarks, brand, goodwill, equipment used to produce goods, or intellectual property.

Total assets (or net assets) are determined by adding your current and non-current assets. In this example, the company’s total assets in 2021 amount to $308,259.

Liabilities

Whereas assets are the things a company owns, liabilities are what they owe. Liabilities are the financial and legal obligations to pay a debtor; they’re tallied as negatives (-) in the balance sheet. Just like assets, liabilities are categorized as current liabilities or non-current liabilities.

Current liabilities

Current liabilities refer to liabilities due to a debtor within one year. This includes payroll expenses, rent, utilities, debt financing, accounts payable, and accrued expenses.

Non-current liabilities

Non-current liabilities refer to long-term liabilities that must be repaid over the longer term, such as leases, long-term debt, including loans, bonds payable, pension fund liability, or deferred tax liabilities. The obligation to provide goods or services in the future is also considered a liability.

In the example provided in this balance sheet template, the company’s total liabilities in 2021 amount to $52,271.

Shareholders Equity

Shareholders equity (or owner’s equity) refers to anything that belongs to the shareholders after liabilities have been accounted for. By adding up all of the assets a business owns and subtracting all the liabilities, the residual left over is the shareholder’s equity.

Shareholders’ equity comprises two elements: money (investment paid in exchange for a degree of ownership, usually represented as shares) and retained earnings (the income generated over time).

In the balance sheet example, we can see that the shareholder’s equity for 2021 equals $255,988.

Reading a Balance Sheet

By consulting the balance sheet example, we can gain insight into the financial position of this (fictional) company.

As with most financial statements, they are typically viewed as a comparison between time periods. In this case, the company’s performance in 2020 and 2021.

We can see the company has spent more on inventory but also holds more cash. Their property and equipment have depreciated, as you would expect. They hold $265,369 in current assets and $42,890 in non-current assets. The company also retained $85,988 in 2021, which is a slight improvement from 2020. There is a healthy ratio of assets and equity versus liabilities.

Conclusion

Your balance sheet is a gauge of the health of your business. Whether you are a business owner, shareholder, or investor, it’s important to understand the story it tells. This way, you can determine what levers to pull to scale your business effectively and efficiently. Chat with us at 10X ERP to learn more about how our software can maximize your profitability as you grow!