Overview

The article primarily emphasizes essential accounting automation tools that operations managers can leverage to enhance their financial processes. It explores various tools, including:

- 10X ERP

- Brex

- FloQast

It illustrates how these solutions streamline tasks, improve accuracy, and significantly reduce the time spent on manual financial processes. This efficiency enables managers to make more informed decisions and ultimately boosts overall operational efficiency.

Introduction

The landscape of accounting is evolving rapidly, driven by an increasing demand for efficiency and accuracy in financial management. Operations managers are turning to automation tools that not only streamline processes but also enhance decision-making capabilities. This article explores ten essential accounting automation tools designed to transform operational efficiency, reduce errors, and free up valuable time for strategic initiatives. With a plethora of options available, how can managers discern which tools will truly impact their organizations?

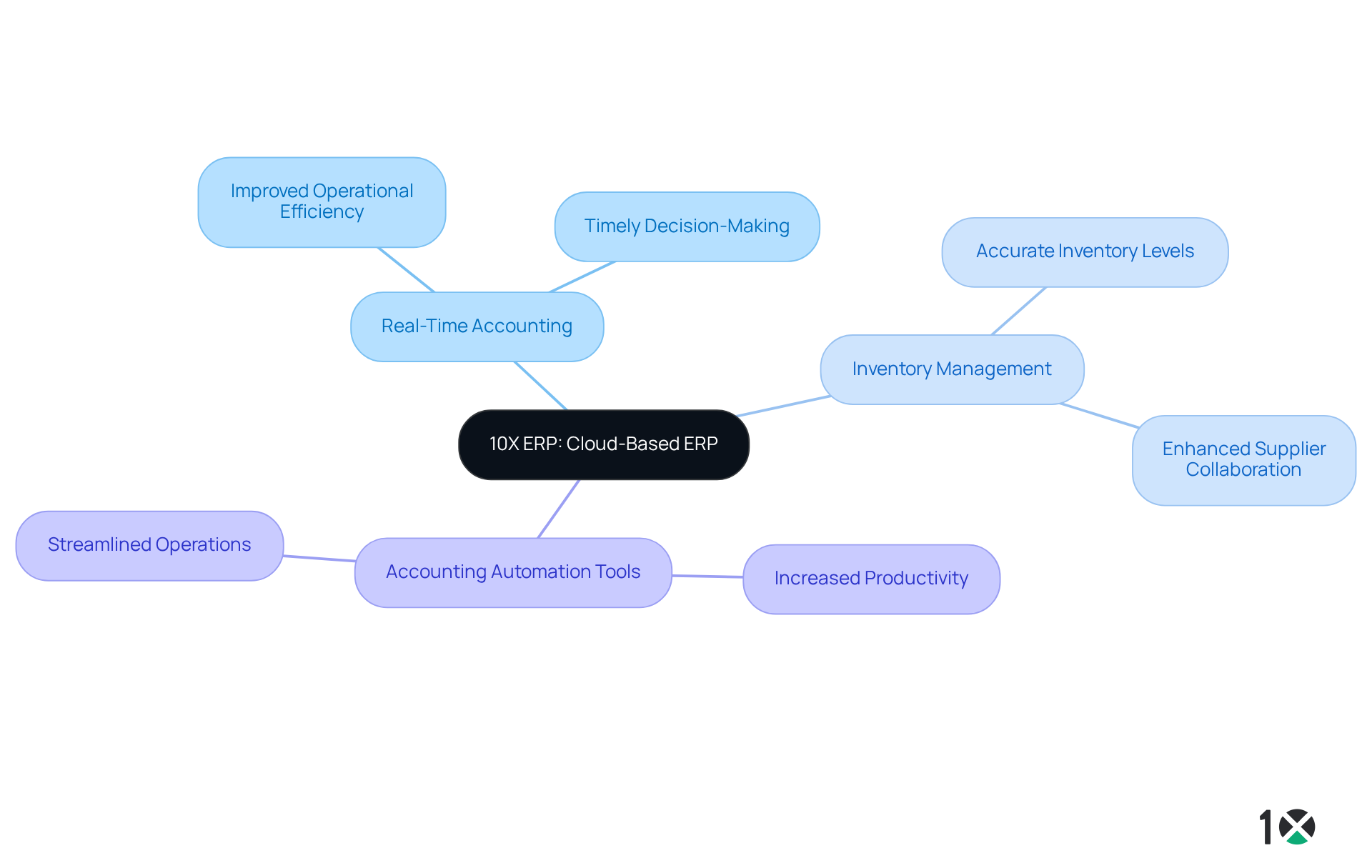

10X ERP: Cloud-Based ERP for Real-Time Accounting and Inventory Management

10X ERP offers a robust cloud-based platform that seamlessly integrates real-time accounting and inventory management through accounting automation tools, specifically designed for distributors. Its intuitive interface empowers operations managers to access crucial financial data from any location, enabling timely and informed decision-making. With real-time data processing, accounting automation tools ensure that inventory levels are accurately reflected in accounting reports, a critical factor for sustaining operational efficiency. This functionality not only streamlines operations but also enhances productivity, allowing distributors to respond swiftly to market demands.

As the cloud ERP market continues to expand, projected to reach $140 billion by 2030, the significance of accounting automation tools in optimizing inventory management and financial operations becomes increasingly clear. Organizations that leverage real-time data have reported notable improvements in operational efficiency, underscoring the transformative impact of 10X ERP on the distribution sector. This is not just a trend; it is a pivotal shift that can redefine how distributors manage their resources and respond to challenges.

Brex: AI-Powered Accounting Automation for Efficient Financial Management

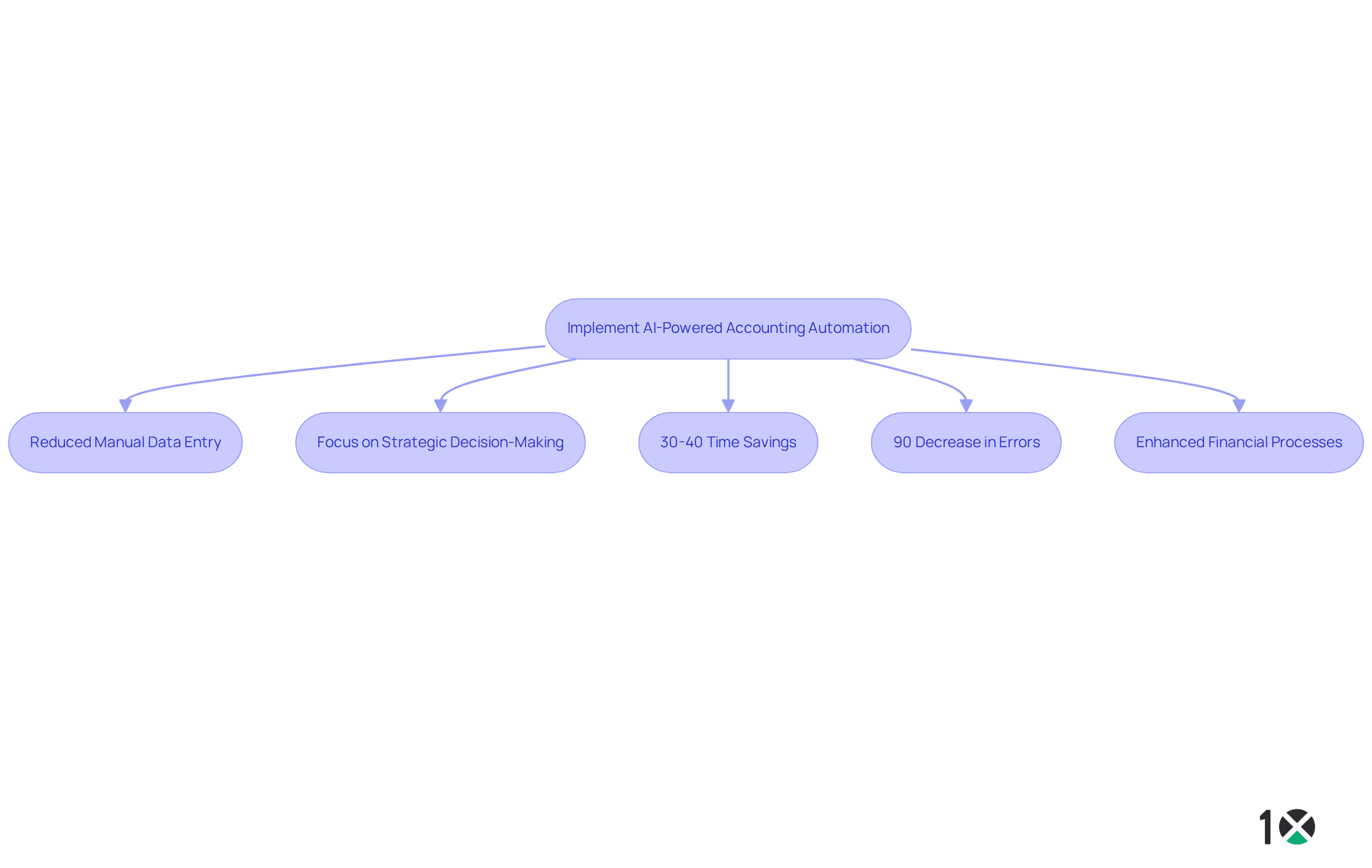

Brex harnesses the power of artificial intelligence to revolutionize accounting tasks, particularly in expense tracking and reporting. By automating these tasks with accounting automation tools, Brex provides real-time insights that significantly enhance precision and productivity. Operations managers experience a reduction in manual data entry, enabling them to shift their focus toward strategic decision-making rather than becoming bogged down by administrative duties.

Research indicates that accounting automation tools can save organizations an estimated 30-40% of the time typically spent on manual financial processes, further streamlining financial management. Moreover, automation can lead to an impressive 90% decrease in errors, ensuring that reporting remains both precise and trustworthy. As AI technology advances, supervisors are finding that accounting automation tools like Brex are essential for enhancing their financial processes and fostering business growth.

Establishing and consistently evaluating key performance indicators (KPIs) is crucial for analyzing the effectiveness of automation initiatives. This practice ensures that operations managers can accurately gauge the impact of these tools on their financial systems.

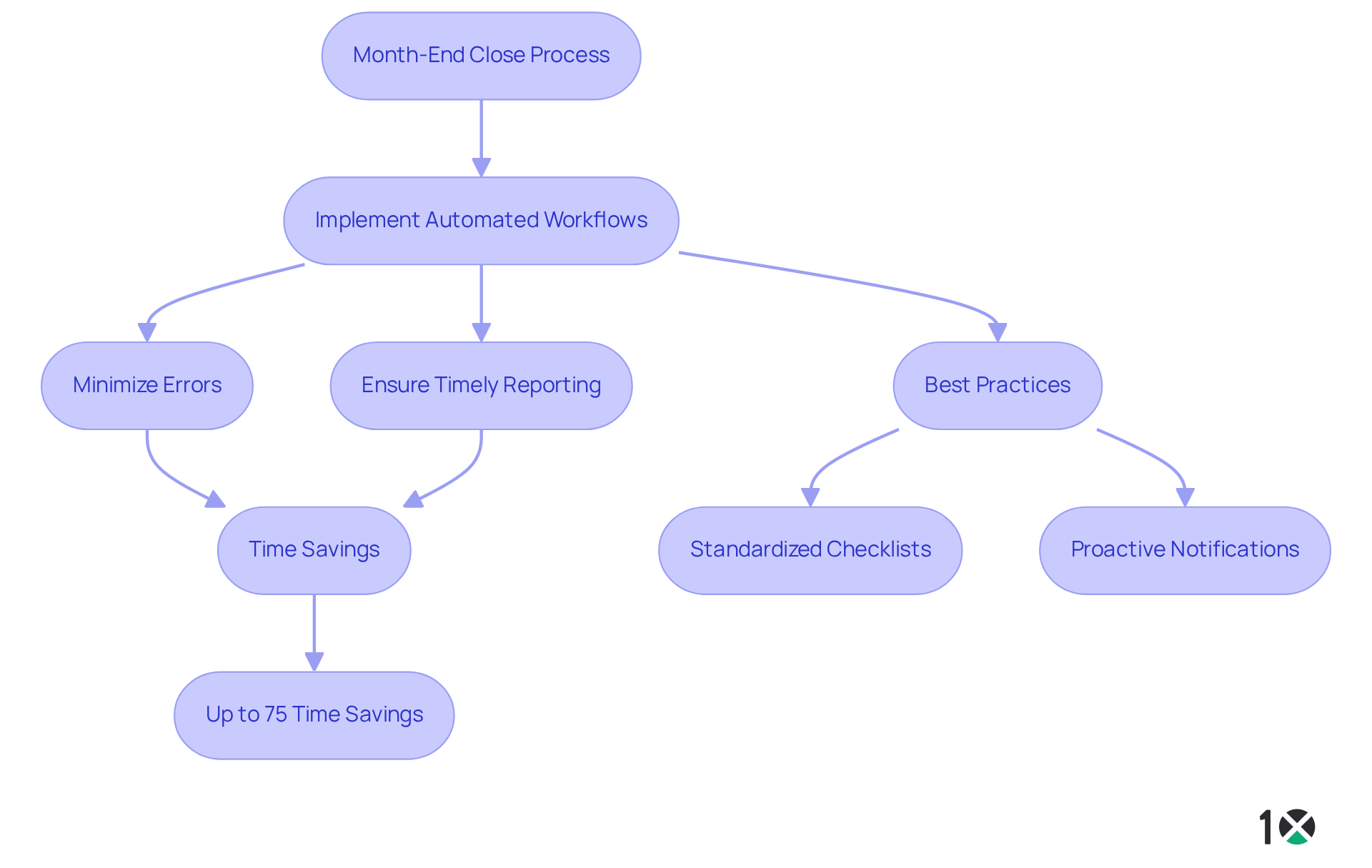

FloQast: Streamline Your Month-End Close with Automated Workflows

FloQast offers powerful accounting automation tools for automating month-end close processes, integrating seamlessly with existing accounting systems to enhance operational efficiency. By streamlining workflows, it significantly minimizes errors and guarantees timely financial reporting. Operations managers can anticipate an impressive average time savings of up to 75% in their month-end close, with some organizations reducing their close time from three weeks to just three days, as underscored by a study on the impact of automation.

The use of accounting automation tools not only improves precision but also provides greater visibility into the closing process, facilitating quicker adjustments and more informed decision-making. For example, Sam Upton, Vice President and Controller at Passport, remarked that FloQast Ops has enabled them to achieve clean audits with no adjustments needed, demonstrating the effectiveness of automated workflows in delivering reliable financial data.

To further enhance efficiency and accountability, teams can adopt best practices such as:

- Standardized checklists

- Proactive notifications

These practices foster collaboration and ultimately transform the month-end close into a streamlined operation. Supervisors should consider developing a comprehensive checklist for month-end activities to ensure all steps are followed and deadlines met.

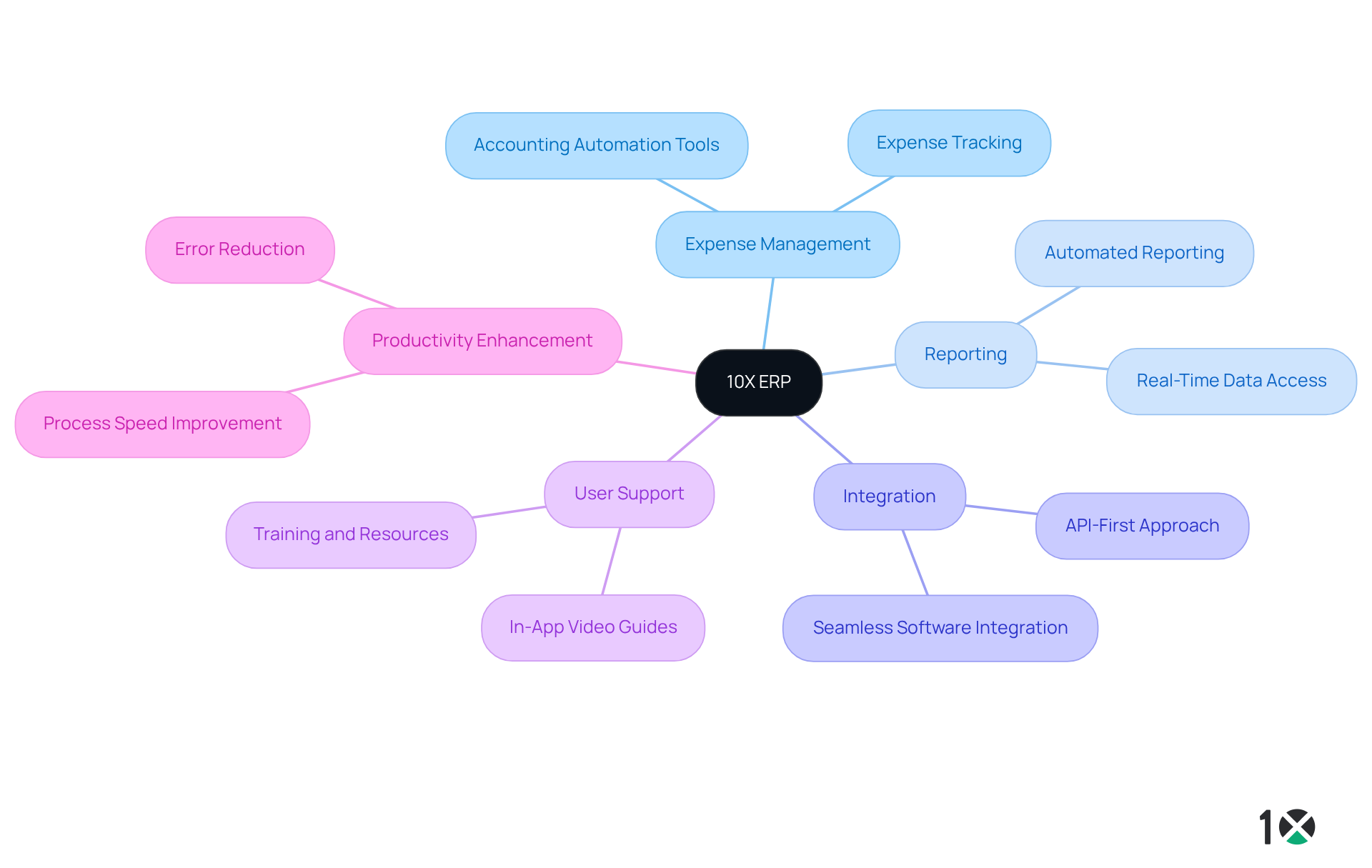

Ramp: Accelerate Financial Processes with User-Friendly Automation

10X ERP offers a robust platform that streamlines various monetary processes, such as expense management and reporting, by utilizing accounting automation tools. With its intuitive interface, developed on a modern tech stack, operations managers can quickly adapt to the system, ensuring that automation boosts productivity rather than impeding it. The API-first approach of 10X ERP facilitates seamless integration with virtually any software utilized by your business, directly optimizing workflows.

Moreover, in-app video guides crafted by the developers deliver essential training and support, empowering users to find solutions swiftly without exiting the application. By refining monetary workflows, 10X ERP utilizes accounting automation tools to enable teams to accelerate their operations and improve overall effectiveness. Embrace the power of 10X ERP to transform your financial management processes today.

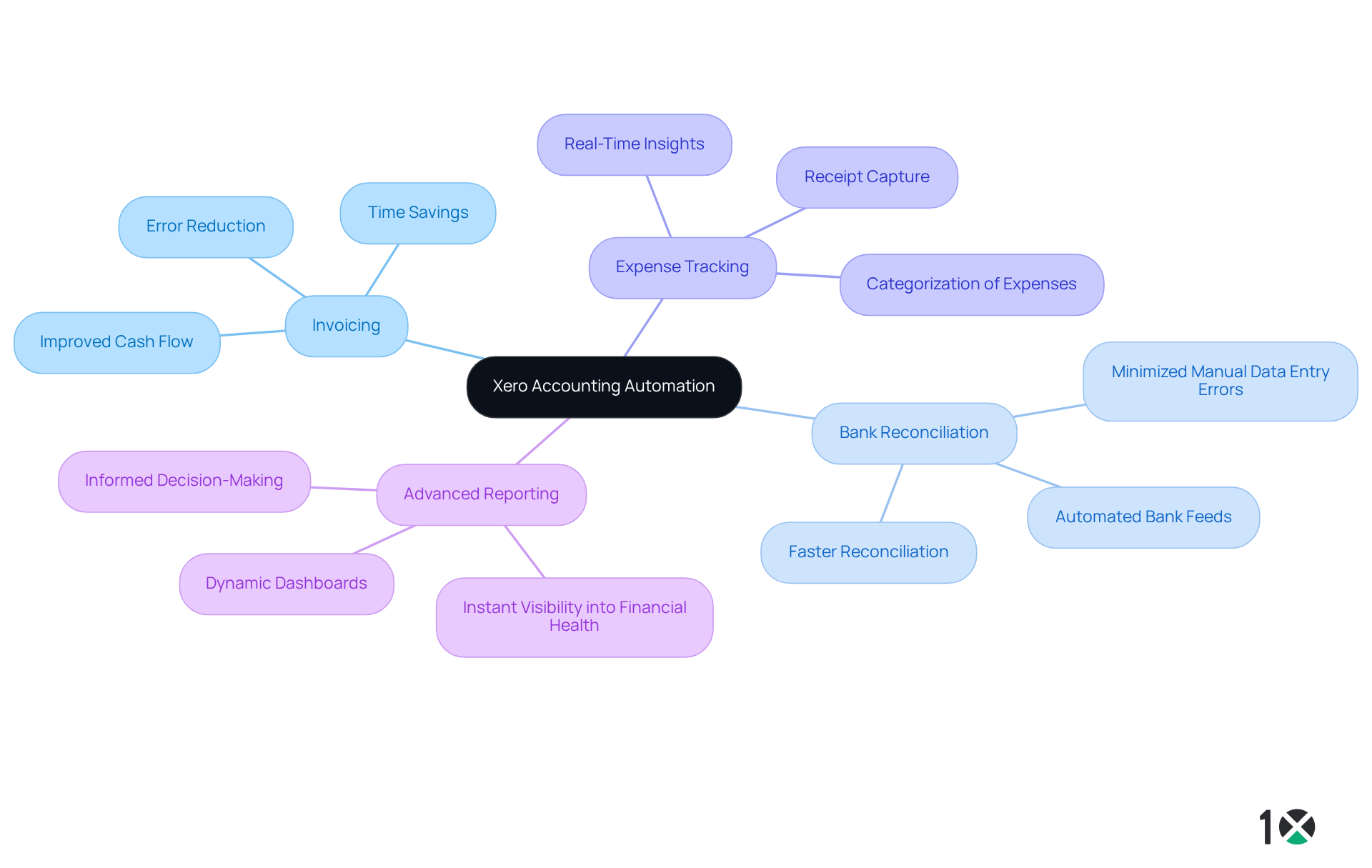

Xero: Comprehensive Accounting Automation for Small Businesses

Xero offers a powerful suite of accounting automation tools that are specifically designed for small businesses. These accounting automation tools include invoicing, bank reconciliation, and expense tracking, all available through a cloud-based platform. Operations managers can leverage Xero to refine their financial processes, ensuring accurate and timely reporting.

Automating financial tasks with accounting automation tools can save organizations between 30-40% of the time typically spent on manual activities, significantly boosting efficiency. With features such as accounting automation tools, including automated bank feeds, Xero minimizes manual data entry errors and accelerates reconciliation, allowing teams to concentrate on strategic decision-making.

In 2025, Xero will introduce advanced reporting capabilities and dynamic dashboards, providing instant visibility into financial health. This empowers managers to make informed decisions swiftly, adapting to market fluctuations with ease. Furthermore, small businesses utilizing Xero’s cloud-based accounting solutions can gain a competitive edge, as those employing cloud systems attract five times more customers than their traditional counterparts.

It is crucial for managers to implement robust security protocols and encryption techniques to protect sensitive financial data in automated accounting systems. By optimizing financial workflows with Xero, managers can ensure their organizations remain agile and competitive in a rapidly evolving business landscape.

QuickBooks: Leading Accounting Software with Automation Features

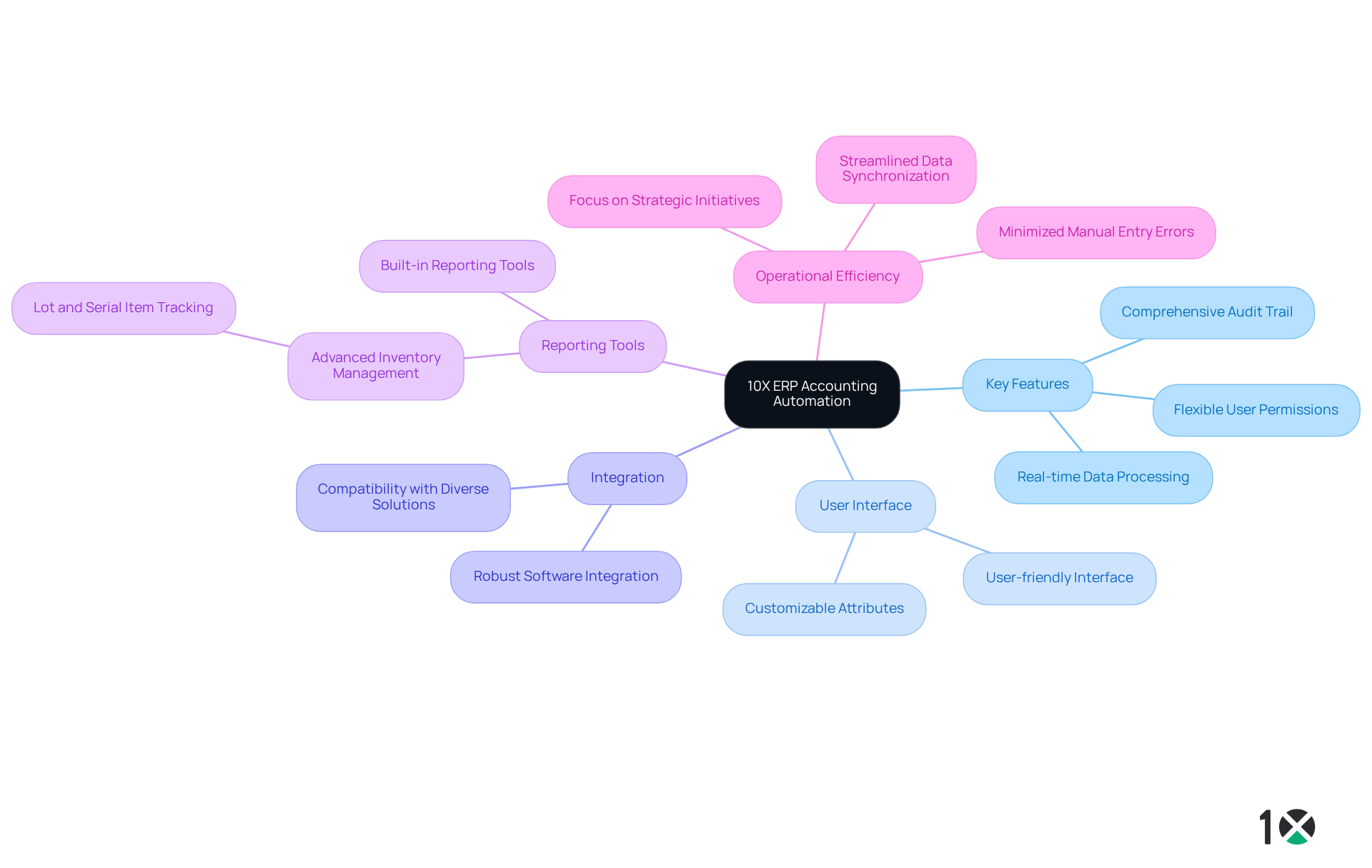

10X ERP emerges as a premier choice for accounting automation, featuring essential capabilities such as real-time data processing, flexible user permissions, and a comprehensive audit trail. Its robust integration with diverse software solutions enhances adaptability, establishing it as a vital instrument for administrators aiming to refine their accounting processes.

The user-friendly interface of 10X ERP promotes swift adaptation, empowering teams to harness automation features effectively. With strong cross-referencing and customizable attributes, 10X ERP ensures that supervisors can manage complex financial tasks with ease.

Additionally, built-in reporting tools and advanced inventory management solutions, including lot and serial item tracking, streamline data synchronization and minimize manual entry errors, thereby boosting operational efficiency. As companies increasingly adopt automation tools, 10X ERP remains at the forefront, allowing teams to focus on strategic initiatives while maintaining accurate financial records.

In today’s economic landscape, where 91% of accountants acknowledge that rising prices and higher interest rates threaten client growth, leveraging automation tools like 10X ERP is crucial for sustaining competitiveness and efficiency.

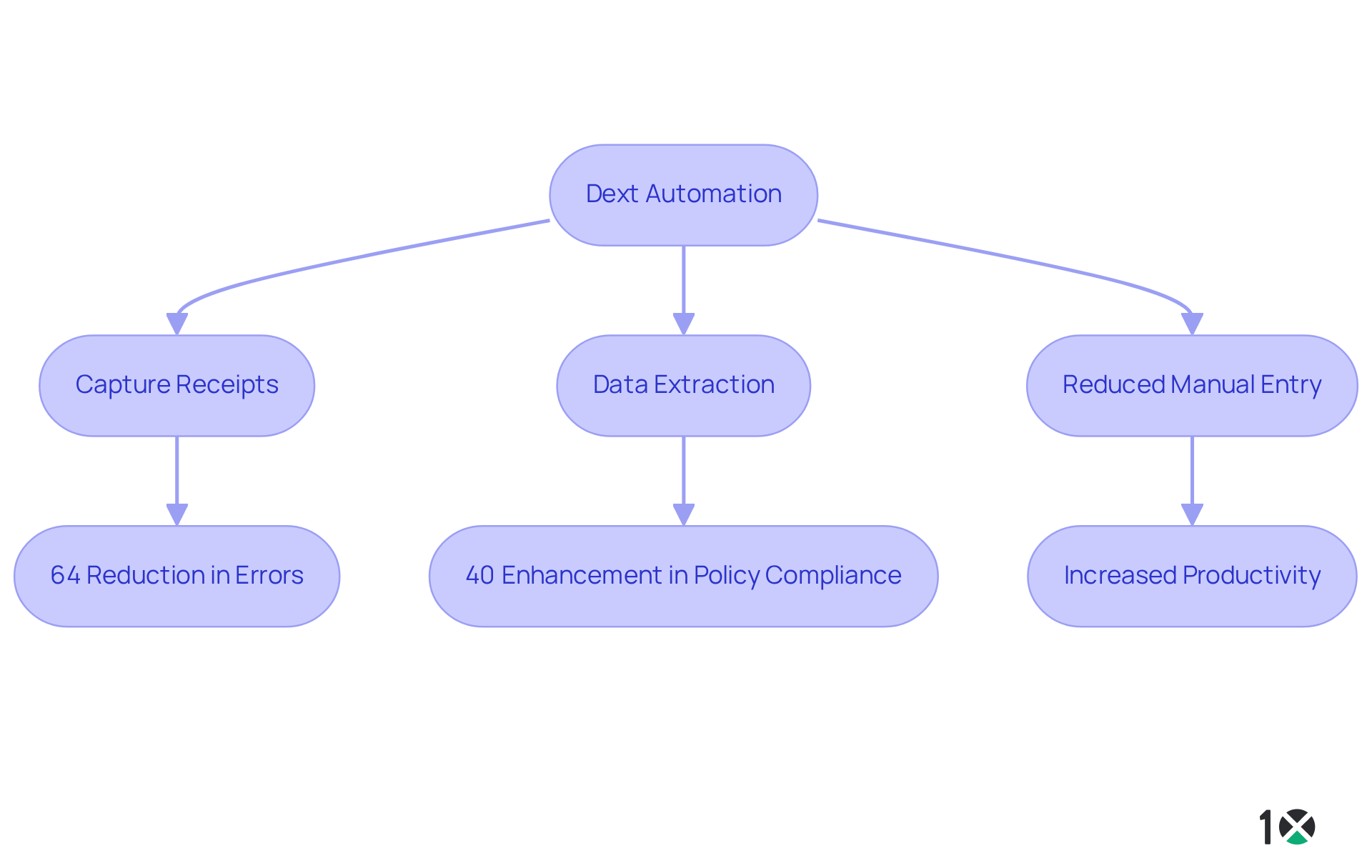

Dext: Automate Expense Management and Data Extraction

Dext revolutionizes expense oversight and data retrieval, empowering operations leaders to optimize their financial workflows. By using accounting automation tools to automate the capture of receipts and data extraction, Dext significantly reduces the time spent on manual entry—an often error-prone process. This automation not only boosts accuracy but also ensures compliance with company policies, effectively mitigating the risk of expense fraud. Notably, organizations that have adopted accounting automation tools report a remarkable 64% reduction in errors and a 40% enhancement in policy compliance. Additionally, AI-powered expense verification swiftly identifies fraudulent claims, further solidifying Dext’s role in promoting compliance and minimizing fraud risk.

Moreover, Dext equips finance teams with the tools to maintain stringent control over expenses, offering real-time insights into spending patterns. Such visibility is essential for informed budgetary decisions and pinpointing areas ripe for cost savings. Operations supervisors leveraging Dext can focus on strategic initiatives rather than being bogged down by administrative tasks, ultimately leading to increased productivity and operational efficiency. As businesses increasingly adopt accounting automation tools such as Dext, they position themselves for success in a competitive landscape, ensuring financial accuracy and streamlined operations. Furthermore, the potential of AI to uncover cost-saving opportunities underscores the indispensable value of automation in expense management.

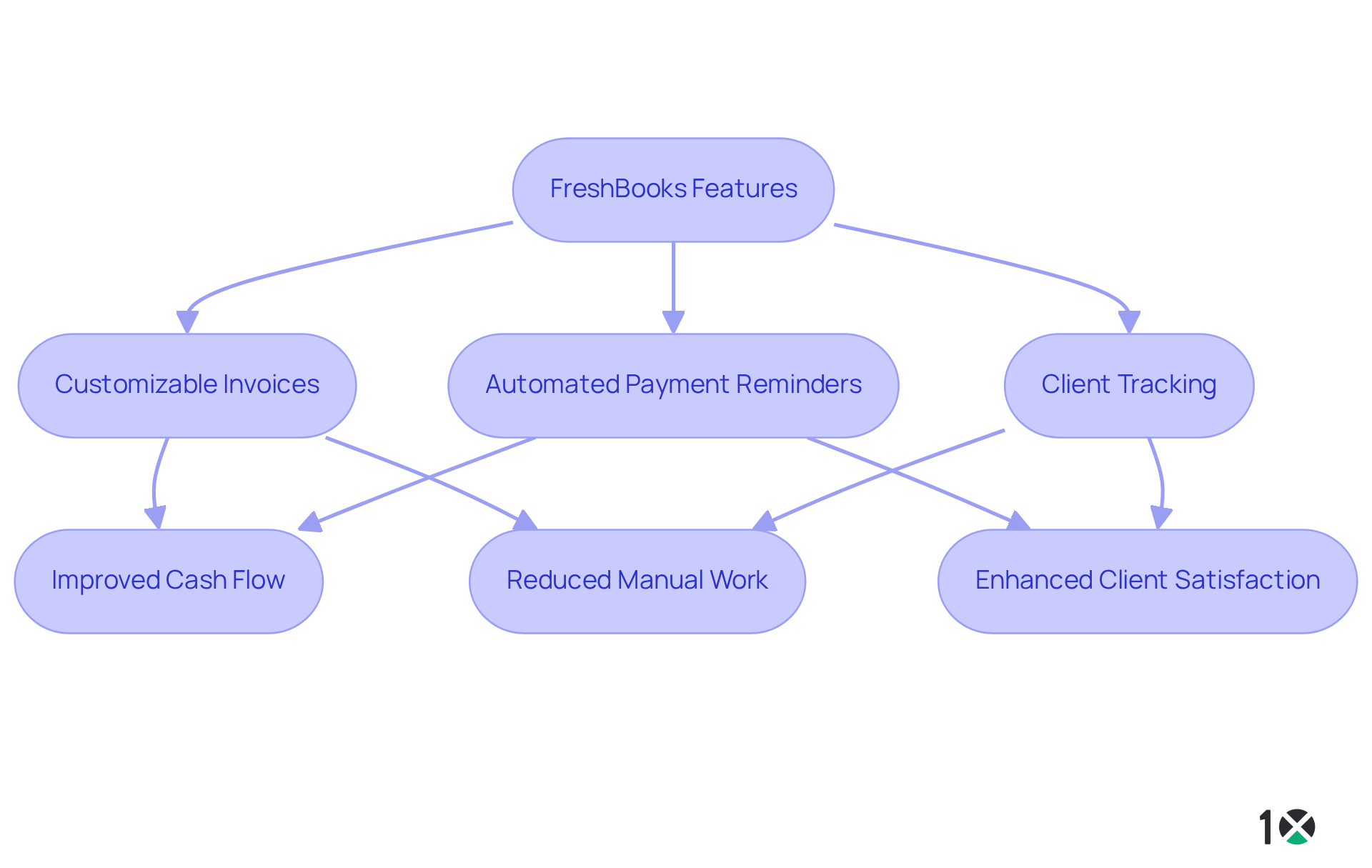

FreshBooks: Invoicing and Client Management Automation for Service Providers

FreshBooks excels in automating invoicing and client management, specifically tailored for service providers. With robust features such as customizable invoices, supervisors can effectively reflect their brand identity. Automated payment reminders enhance cash flow by ensuring timely payments, while comprehensive client tracking fosters stronger relationships.

By utilizing FreshBooks, administrators can optimize their invoicing methods, significantly decreasing the time dedicated to manual activities and minimizing mistakes. In fact, automated systems can process invoices 3 to 5 times faster than manual methods. This not only improves operational efficiency but also enhances client satisfaction.

As trends in client management automation continue to progress, FreshBooks remains an essential resource for supervisors seeking to enhance their budgetary processes and improve client engagements using accounting automation tools. Notably, 84% of firms that have fully utilized accounting automation tools for their accounts payable report improved cash flow and savings. This statistic underscores FreshBooks as a crucial investment for those aiming to elevate their financial processes.

ADP Run: Payroll Automation for Accurate Employee Payments

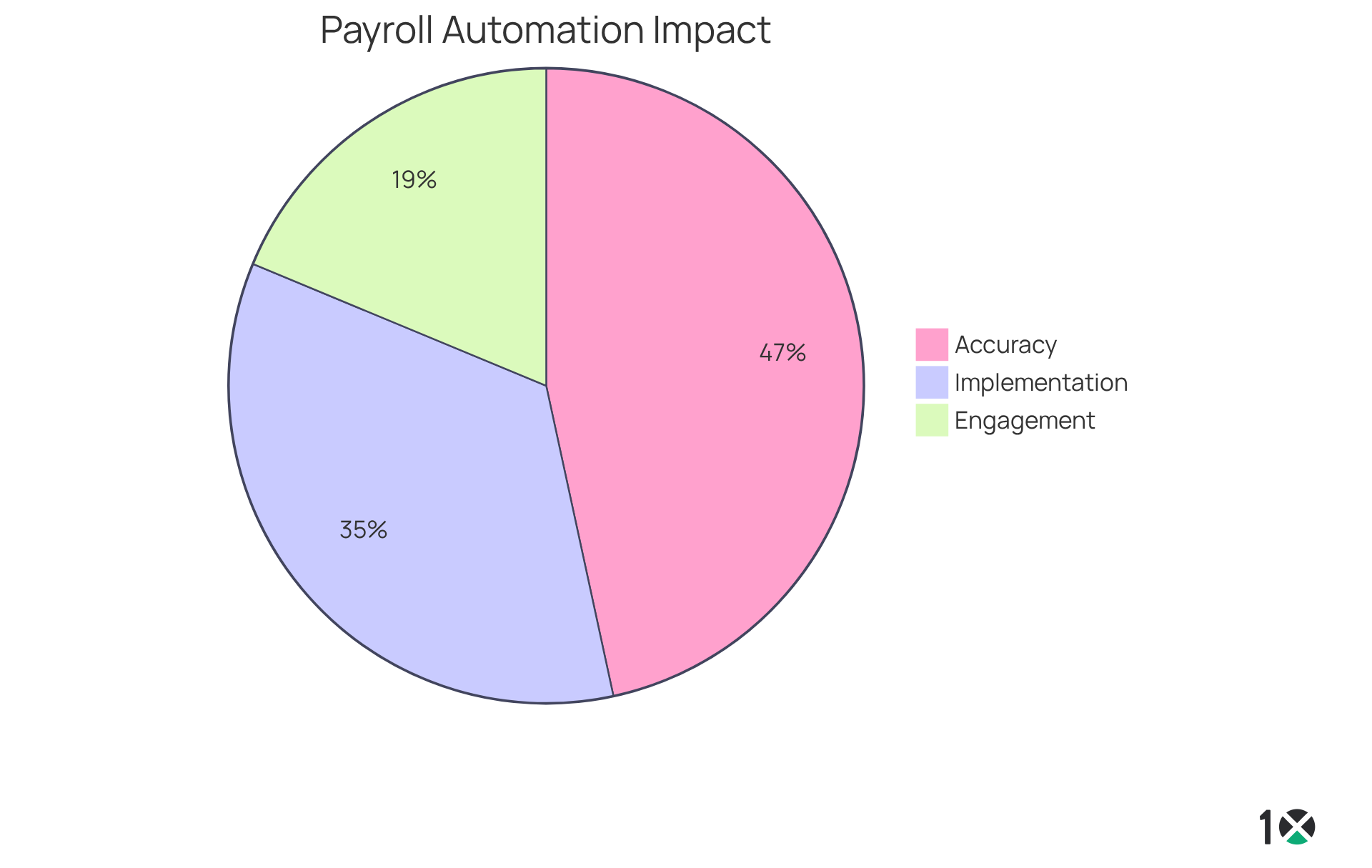

ADP Run streamlines payroll automation, guaranteeing precise and timely employee payments. This powerful tool simplifies complex tasks, including tax calculations, benefits management, and compliance reporting. As a result, operations managers can shift their focus from administrative duties to strategic initiatives.

By automating payroll tasks, businesses can significantly minimize mistakes—companies utilizing automated payroll systems report up to 99.5% accuracy. Timely and accurate payments are crucial for maintaining employee trust and engagement; studies indicate that employees paid on time are 40% more likely to be engaged in their work. Furthermore, 74% of organizations have implemented accounting automation tools to automate some part of their payroll process, reflecting a growing trend in the industry.

As administrators increasingly embrace ADP Run, they enhance payroll efficiency and cultivate a more content and productive workforce. As Anh Nguyen, an HR tech researcher, notes, “Automated payroll systems can reduce payroll processing time by 80%, allowing businesses to focus on strategic initiatives.” This underscores the importance of adopting accounting automation tools to not only improve operational efficiency but also to foster a more engaged workforce.

Spendesk: Integrated Spend Management for Automated Expense Tracking

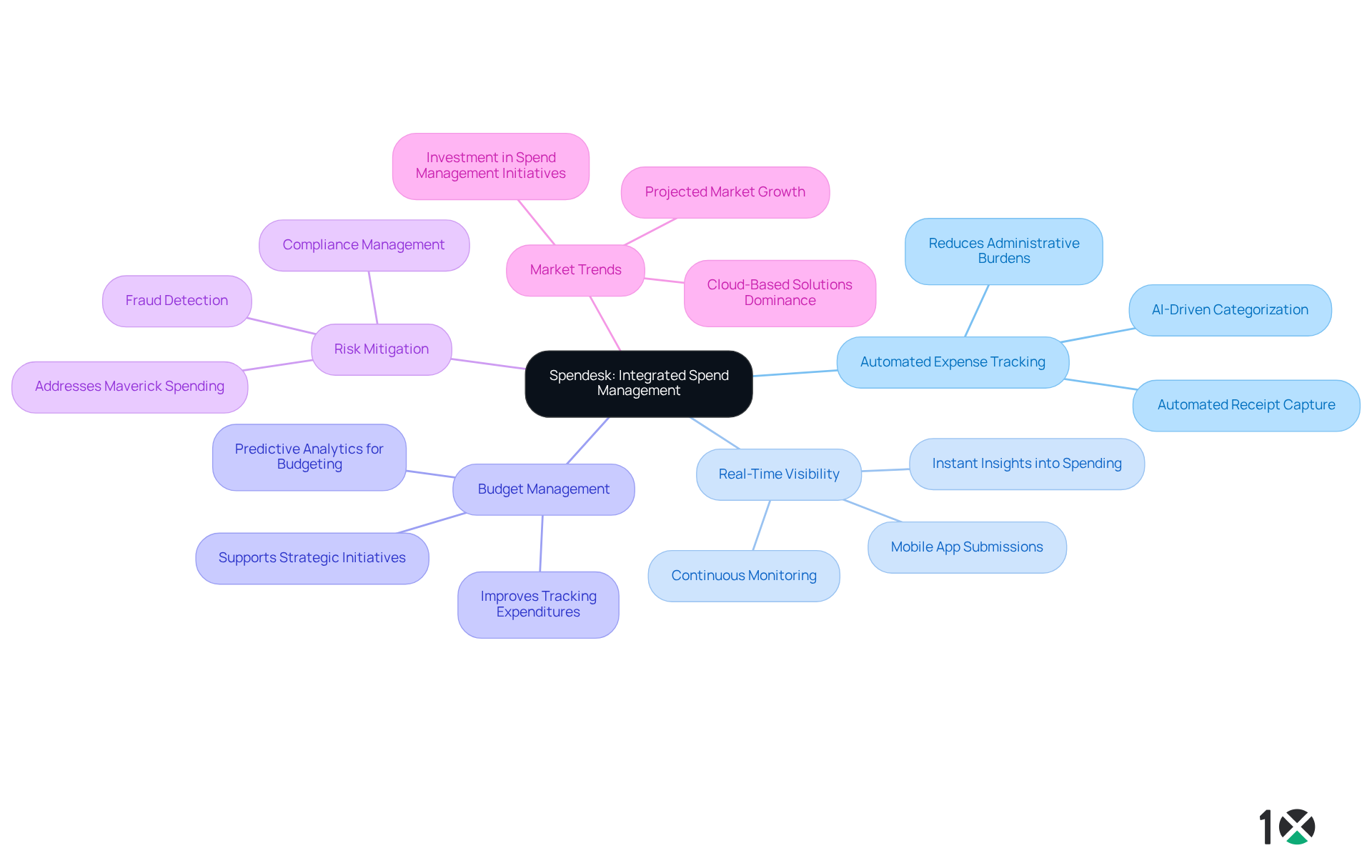

Spendesk delivers a robust integrated spend management solution that automates expense tracking and approval workflows. This empowers operations supervisors with real-time visibility into spending, which is crucial for maintaining budget adherence and effectively managing expenses. By automating these processes, Spendesk enhances control over expenditures while also mitigating the risk of maverick spending—a concern for 49% of senior decision-makers in the UK.

Operations supervisors utilizing Spendesk have reported significant improvements in tracking expenditures, fostering a disciplined approach to budget management. A study by ExpenseOut indicates that accounting automation tools for expense tracking can reduce administrative burdens by up to 80%, enabling finance teams to concentrate on strategic initiatives rather than manual data entry. Furthermore, with automated notifications for policy breaches and real-time analytics, operations managers can make informed choices that align with organizational objectives, ultimately enhancing economic performance and operational efficiency.

The Business Spend Management (BSM) software market is projected to reach $57.22 billion by 2032, underscoring the increasing relevance of tools like Spendesk in optimizing financial processes. This trend highlights the necessity for operations managers to adopt comprehensive solutions, such as accounting automation tools, that not only streamline spending but also drive organizational success.

Conclusion

The integration of accounting automation tools is revolutionizing the landscape for operations managers, empowering them to enhance efficiency and accuracy across financial processes. By leveraging technologies such as cloud-based ERP systems, AI-driven solutions, and comprehensive expense management tools, organizations can streamline operations, minimize manual errors, and make data-driven decisions with remarkable ease. This transformation not only optimizes resource management but also enables teams to concentrate on strategic initiatives that propel business growth.

Throughout this article, essential tools like 10X ERP, Brex, FloQast, and others have been underscored for their unique capabilities in automating various accounting functions. From real-time inventory management to automated payroll systems, each tool plays a pivotal role in improving operational efficiency. The potential time savings, accuracy enhancements, and the ability to maintain compliance are critical factors that highlight the necessity of adopting these technologies in contemporary financial management.

As the demand for efficiency in accounting processes escalates, operations managers are strongly encouraged to embrace these automation tools to remain competitive. The future of accounting hinges on leveraging technology to not only simplify tasks but also to cultivate a more engaged workforce and elevate overall productivity. Investing in these solutions will not only streamline operations but also position organizations for success in an ever-evolving business environment.

Frequently Asked Questions

What is 10X ERP and what does it offer?

10X ERP is a cloud-based platform that integrates real-time accounting and inventory management through accounting automation tools, specifically designed for distributors. It allows operations managers to access crucial financial data from any location, enhancing decision-making and operational efficiency.

How does 10X ERP improve inventory management?

10X ERP uses real-time data processing to ensure that inventory levels are accurately reflected in accounting reports, which streamlines operations and enhances productivity, allowing distributors to respond quickly to market demands.

What is the projected growth of the cloud ERP market?

The cloud ERP market is projected to reach $140 billion by 2030, highlighting the increasing importance of accounting automation tools in optimizing inventory management and financial operations.

How does Brex utilize artificial intelligence in accounting?

Brex harnesses AI to automate accounting tasks such as expense tracking and reporting, providing real-time insights that enhance precision and productivity while reducing manual data entry for operations managers.

What time savings can organizations expect from using accounting automation tools like Brex?

Organizations can save an estimated 30-40% of the time typically spent on manual financial processes by using accounting automation tools, significantly streamlining financial management.

What impact does automation have on error rates in financial reporting?

Automation can lead to a 90% decrease in errors, ensuring that financial reporting remains precise and trustworthy.

How does FloQast improve the month-end close process?

FloQast automates month-end close processes, integrating with existing accounting systems to enhance operational efficiency, minimize errors, and guarantee timely financial reporting.

What time savings can be achieved by using FloQast?

Operations managers can save an average of up to 75% in their month-end close time, with some organizations reducing their close time from three weeks to just three days.

What best practices can teams adopt to enhance efficiency in the month-end close process?

Teams can adopt standardized checklists and proactive notifications to foster collaboration and streamline the month-end close operation.

Why is it important to establish and evaluate key performance indicators (KPIs) in automation initiatives?

Establishing and evaluating KPIs is crucial for analyzing the effectiveness of automation initiatives, allowing operations managers to gauge the impact of these tools on their financial systems accurately.