Overview

Automated invoice processing presents distributors with a multitude of advantages, including significant cost reduction, substantial time savings, enhanced accuracy, and improved supplier relationships. This article delineates how automation effectively minimizes manual errors, accelerates billing cycles, and facilitates real-time data access. Collectively, these factors contribute to increased operational efficiency and profitability for businesses.

By embracing automation, organizations can streamline their processes, reduce the risk of errors, and foster stronger partnerships with suppliers. The transition to automated systems not only accelerates workflows but also empowers businesses with timely insights, enabling informed decision-making.

In conclusion, the implementation of automated invoice processing is not merely an operational upgrade; it is a strategic move that can position distributors for greater success in a competitive landscape. Businesses are encouraged to consider this transformative approach to enhance their operational capabilities.

Introduction

Automated invoice processing is revolutionizing the way distributors manage their billing systems, offering a myriad of advantages that extend beyond mere efficiency. By embracing this technology, businesses can unlock significant cost reductions, time savings, and enhanced accuracy in their financial operations. As the landscape of distribution continues to evolve, companies are prompted to consider:

- How can they fully leverage these automated systems to streamline processes while fostering stronger relationships with suppliers and adapting to future growth?

This article delves into the seven key benefits of automated invoice processing, revealing how it can transform the operational framework of distributors and position them for sustained success.

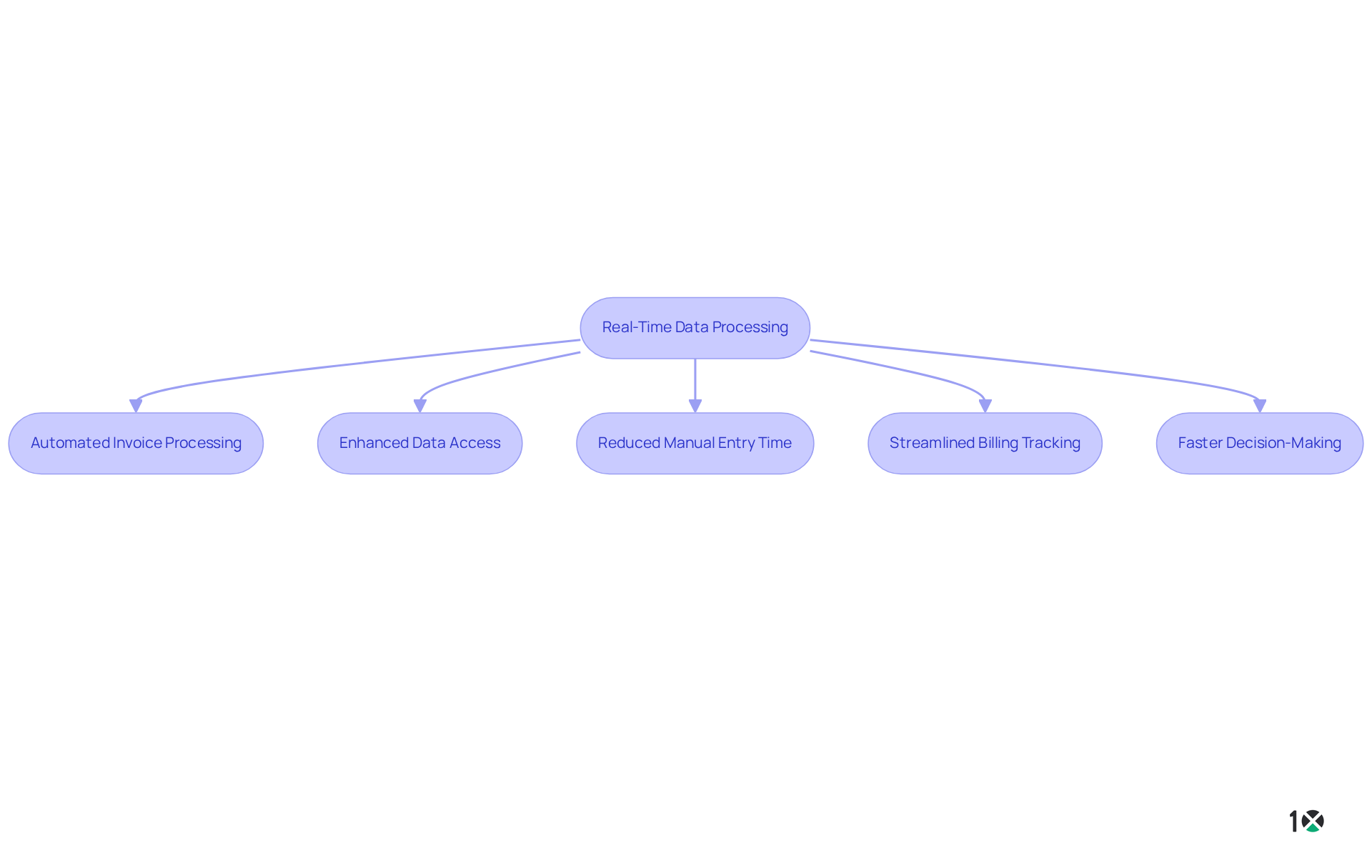

10X ERP: Real-Time Data Processing for Efficient Invoice Management

10X ERP harnesses the power of real-time data processing to significantly enhance the creation, monitoring, and administration of billing statements. This capability provides suppliers with immediate access to current transaction details, drastically minimizing the time allocated to manual data entry and reconciliation. By utilizing automated invoice processing, businesses can operate with the latest data, which is essential for sustaining cash flow and boosting operational efficiency. The integration of real-time data not only streamlines billing tracking but also facilitates quicker decision-making, empowering sellers to respond swiftly to financial fluctuations and maintain robust supplier relationships. As a result, companies can achieve greater accuracy in their automated invoice processing, which leads to expedited payment cycles and increased overall productivity.

As Brianna Blaney notes, “When you automate billing management, you’ll discover a variety of benefits.

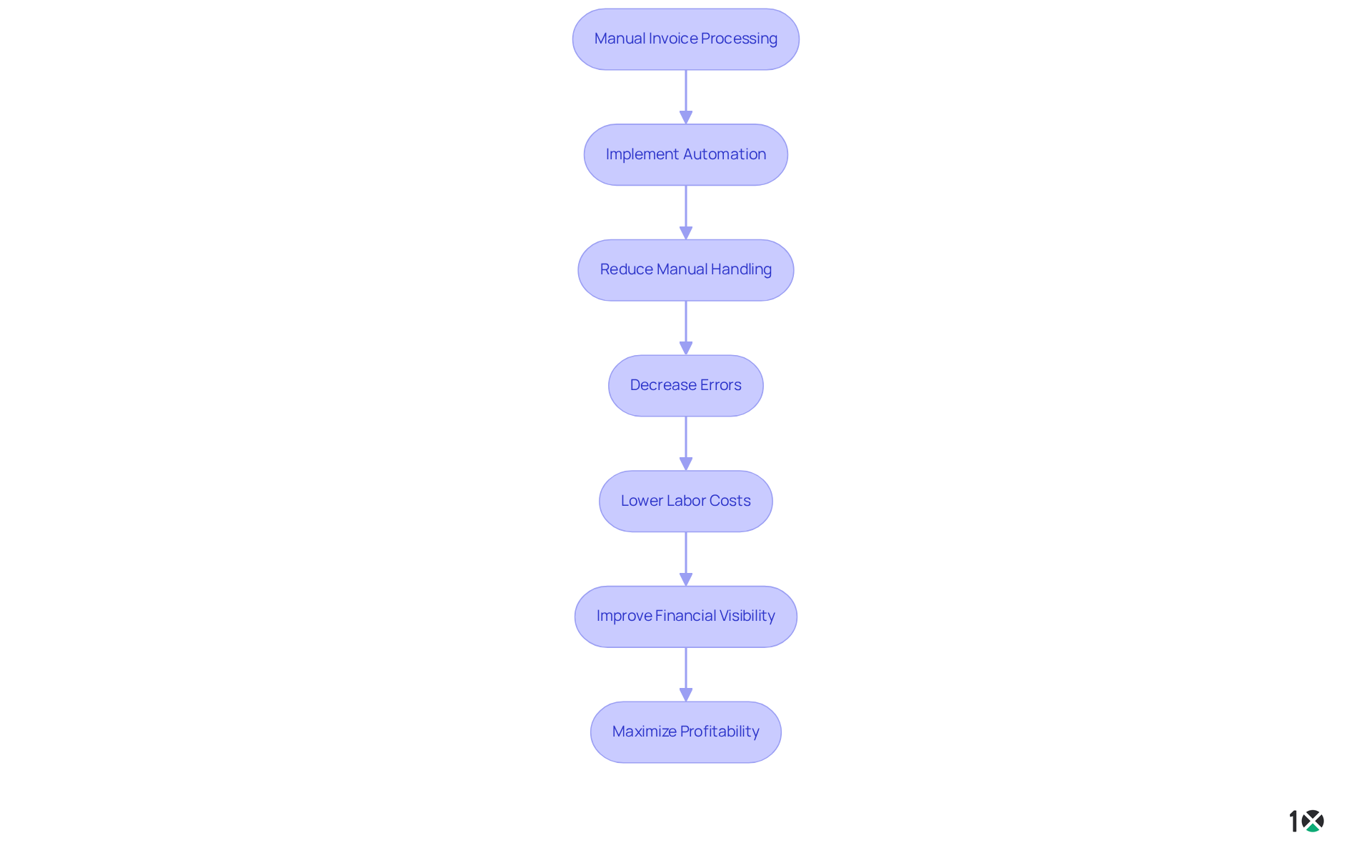

Cost Reduction: Lower Operational Expenses with Automation

Automated invoice processing is crucial for significantly reducing operational costs for suppliers by minimizing reliance on manual processes and decreasing the likelihood of errors that can lead to costly adjustments. By implementing automated invoice processing to optimize the invoicing workflow, distributors can more effectively reallocate resources, allowing them to focus on core business activities rather than administrative tasks.

For instance, organizations that have embraced AP automation, such as Kefron AP, have reported a reduction in manual bill handling by as much as 90%. This shift results in substantial savings in labor costs and operational inefficiencies. Furthermore, typical operational cost reductions from billing automation can reach up to 50%, as businesses benefit from improved financial visibility and enhanced cash flow management.

As noted, automated invoice processing simplifies approvals, eliminates data entry, reduces costs, and enhances financial visibility, empowering wholesalers to negotiate better terms with suppliers and respond more quickly to inquiries. Ultimately, this maximizes profitability and fosters sustainable growth.

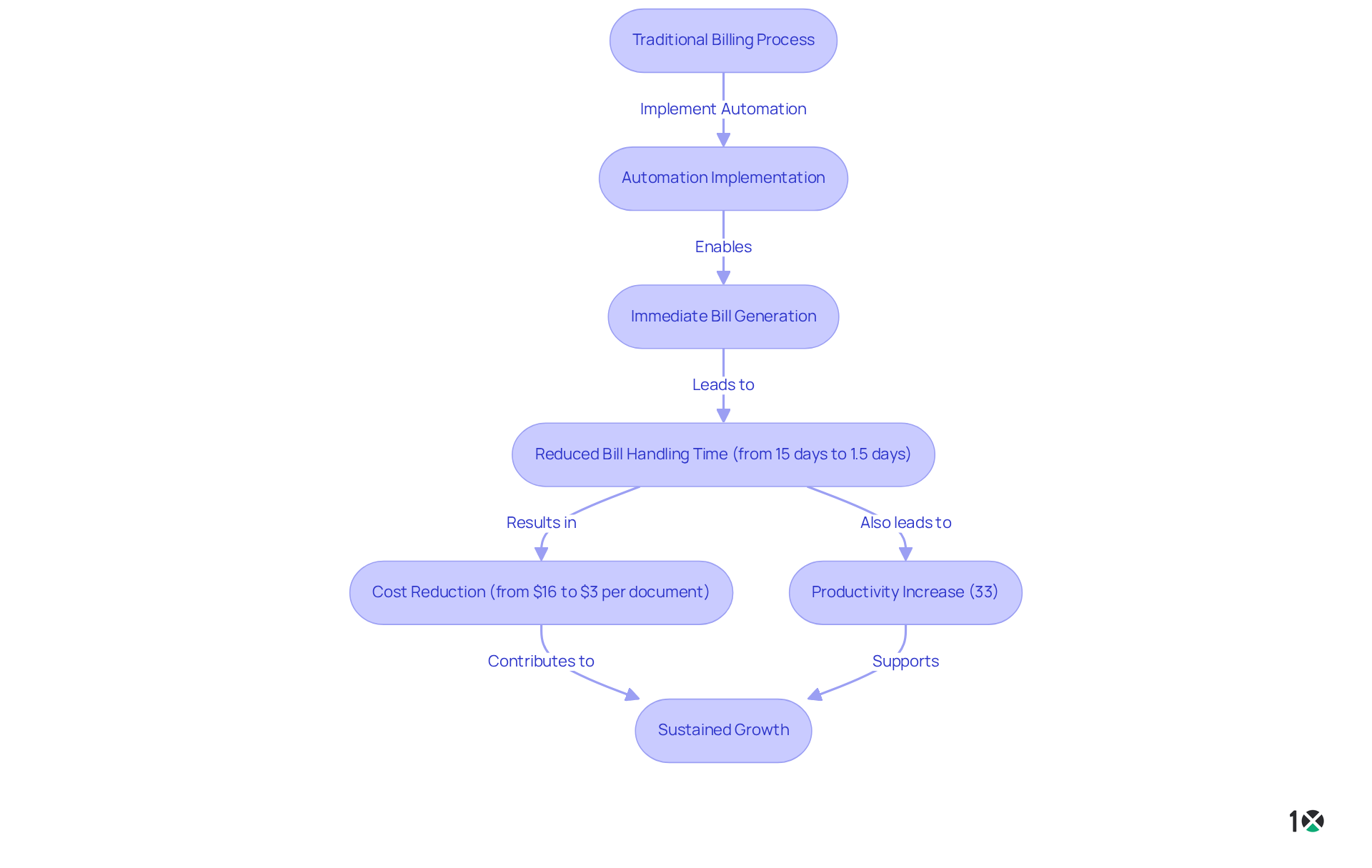

Time Savings: Accelerate Cash Flow Management Through Automation

Automating billing management empowers distributors to significantly enhance their cash flow control. By generating bills immediately after order completion, companies can drastically reduce the interval between service delivery and payment collection. This rapid turnaround not only boosts cash flow but also fortifies relationships with suppliers and customers; prompt invoicing reflects professionalism and reliability.

In fact, automated invoice processing can reduce bill handling duration from 15 days to just 1.5 days, representing a remarkable 10× improvement, and can decrease turnaround time by up to 80%. As organizations increasingly adopt automation, they experience an average expense reduction of 70%, with manual tasks costing as much as $16 per document compared to a mere $3 with automation.

Moreover, businesses leveraging automation have observed a 33% increase in productivity, and those implementing automated invoice processing procedures report a 42% decrease in costs, further underscoring the efficiency gains associated with streamlined billing workflows. Distributors embracing these technologies are not only optimizing their operations but also positioning themselves for sustained growth in a competitive market.

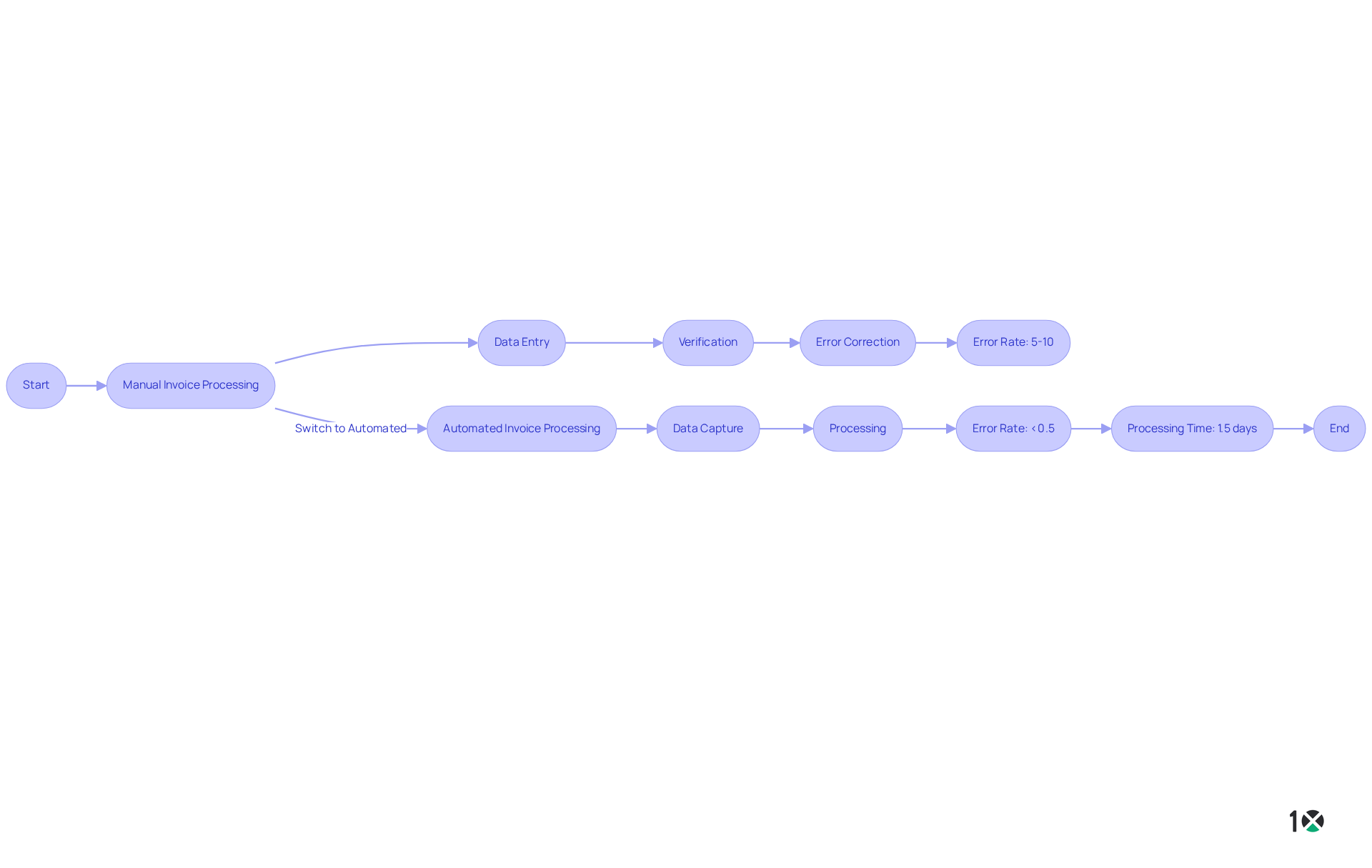

Enhanced Accuracy: Minimize Errors in Invoice Processing

Automated bill management significantly reduces the likelihood of human errors, a common issue in manual systems. By leveraging advanced software that automatically captures and processes billing data, distributors can uphold accurate and up-to-date financial records. This improved accuracy not only prevents costly mistakes but also fosters trust with clients and suppliers, as discrepancies become less frequent.

Organizations that implement automation report error rates of less than 0.5%, compared to an average of 5-10% in manual processes. Additionally, companies adopting automated invoice processing systems have experienced a dramatic decrease in invoice processing times, from an average of 15 days to merely 1.5 days, highlighting the efficiency and reliability of these solutions.

Expert insights underline that minimizing errors in accounting records through automation is vital for maintaining a competitive edge, allowing companies to focus on strategic initiatives rather than rectifying inaccuracies. In a landscape where 66% of businesses still rely on manual methods, it is crucial for suppliers to adopt automated invoice processing systems to enhance operational efficiency and precision.

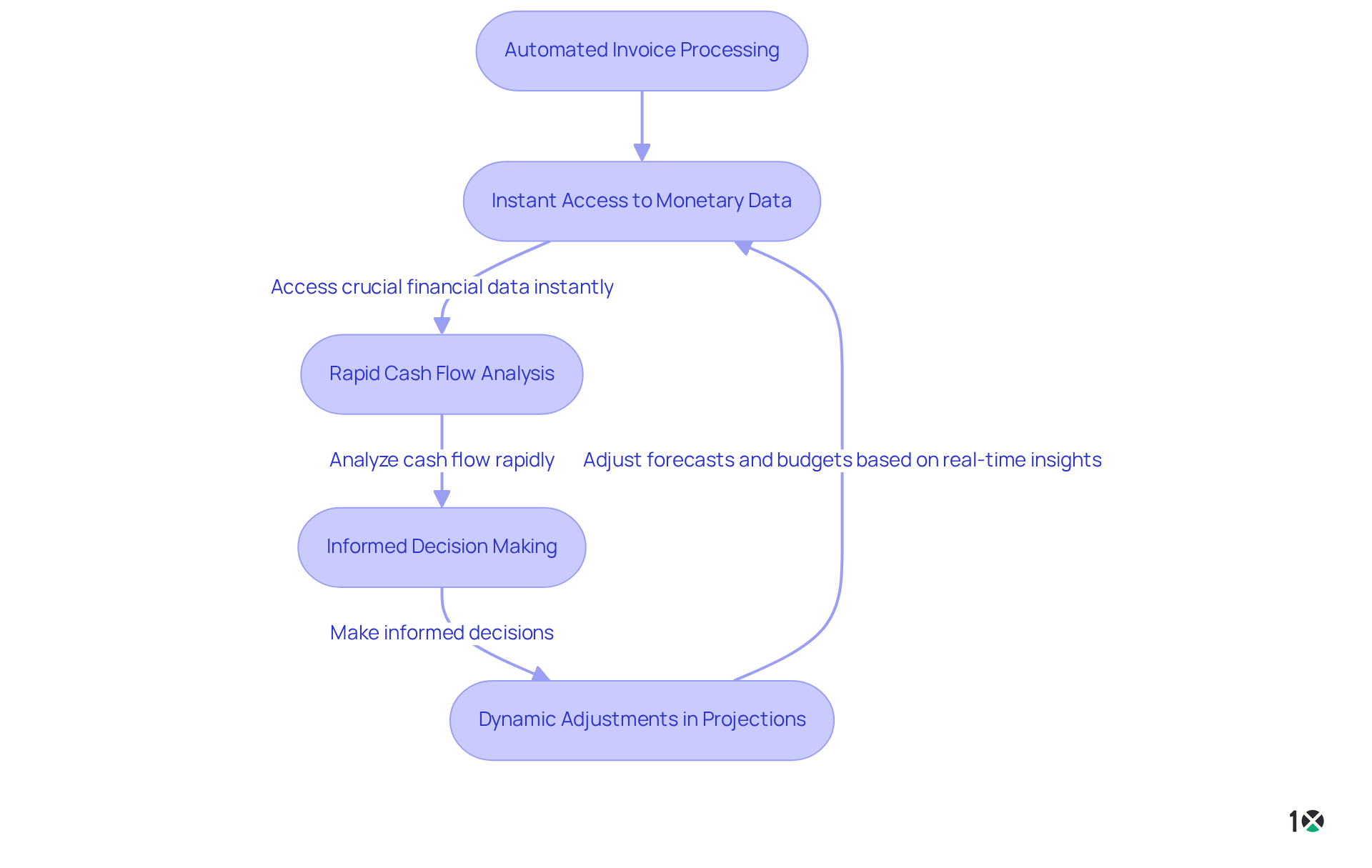

Real-Time Data Access: Make Informed Decisions Instantly

Automated invoice processing provides suppliers with instant access to crucial monetary data, allowing for rapid analysis of cash flow and pending invoices. This real-time availability is vital for decision-makers, allowing them to make informed choices swiftly. In the fast-paced distribution sector, where prompt decisions significantly impact competitiveness, real-time economic data refreshes revenue figures minute by minute. Companies leveraging this data can dynamically adjust forecasts and budgets; finance teams can tweak projections, shift budgets, and redeploy resources as necessary with real-time insights. This flexibility not only enhances cash flow management but also assists suppliers in seizing emerging opportunities, ensuring they stay ahead in a competitive environment.

Moreover, the staggering $2.1 trillion in worldwide losses due to the complexity of monetary software underscores the urgent need for streamlined economic processes. As suppliers embrace automated invoice processing, they must also recognize the critical importance of cybersecurity to protect their financial information and maintain operational integrity. By prioritizing both automation and security, suppliers can navigate the complexities of modern financial management effectively.

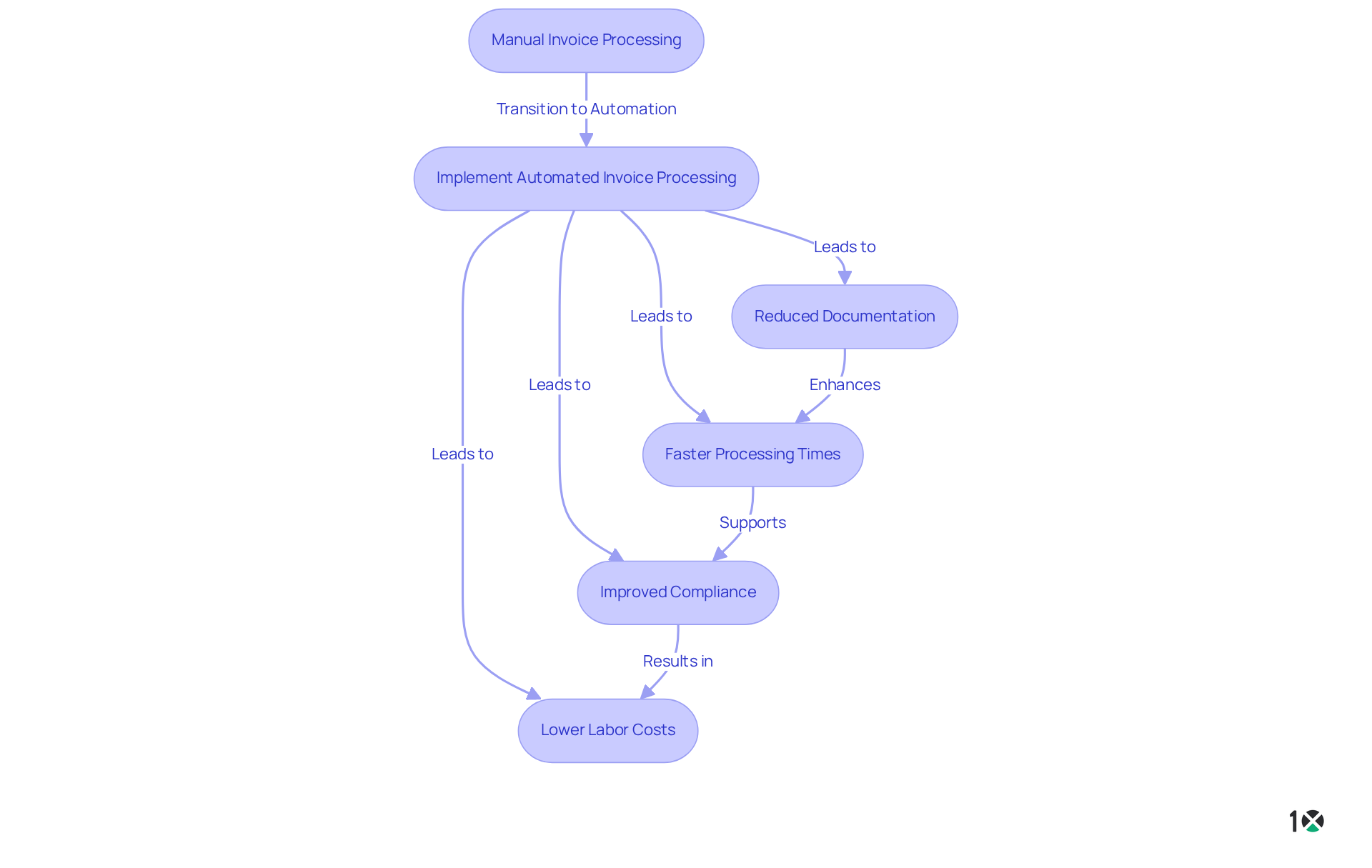

Reduction of Paperwork: Streamline Processes and Ensure Compliance

Automated billing management significantly reduces documentation in monetary transactions. By utilizing automated invoice processing to digitize bills and consolidate them within a centralized system, distributors can streamline their operations while ensuring adherence to regulatory requirements. This change not only speeds up processing times—decreasing billing cycle durations by as much as 60%—but also improves the retrieval and auditing of monetary documents, which is essential for compliance.

Furthermore, automated invoice processing simplifies compliance with local and international tax regulations by automatically applying the correct tax rates. They also generate thorough audit trails that record every step of the billing lifecycle, assisting in adherence to financial regulations. The capability to swiftly retrieve and handle digital records greatly diminishes the likelihood of mistakes, guaranteeing that billing statements are precise and conforming.

Consequently, companies can save an average of $13 per bill, enhancing overall efficiency and lowering labor expenses. Moreover, firms with automated invoice processing handle bills 2.5 times quicker than those relying on manual methods, and this automated billing can reduce errors in payments by 50%. This shift to digital invoicing, which includes automated invoice processing, not only promotes a more structured financial environment but also enables suppliers to better manage the complexities of compliance in today’s regulatory landscape.

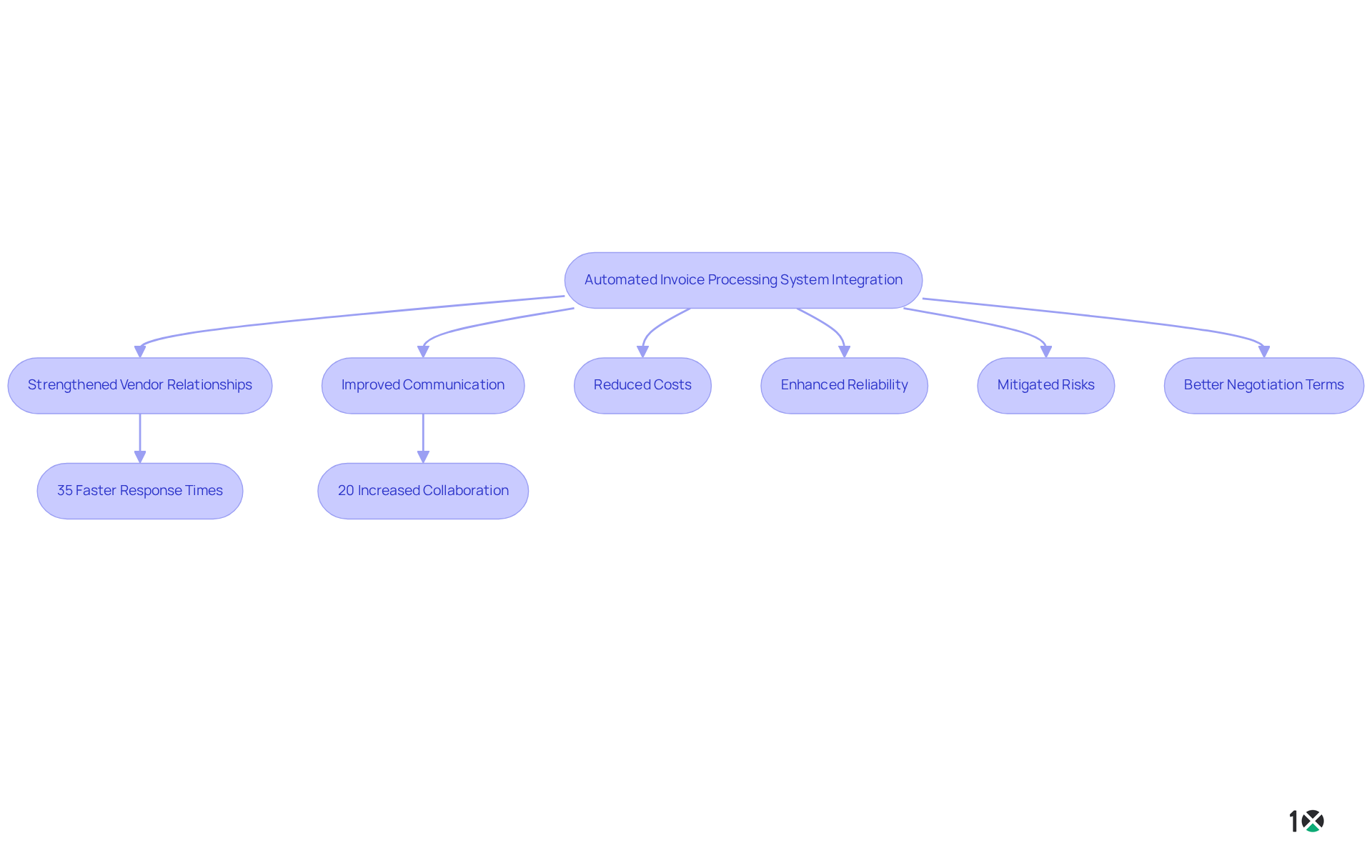

System Integrations: Strengthen Vendor Relationships and Efficiency

Automated invoice processing systems possess advanced integration capabilities that facilitate seamless connections with various software utilized by suppliers. This integration is crucial in fortifying vendor relationships by ensuring that automated invoice processing occurs swiftly and accurately. Consequently, the time spent on disputes is significantly minimized, fostering enhanced communication and collaboration with vendors.

Effective vendor management not only leads to improved communication and reduced costs but also enhances reliability and mitigates risks, further substantiating the claim regarding strengthened vendor relationships and operational efficiency. Improved relationships empower suppliers to negotiate more advantageous terms, ultimately augmenting overall operational efficiency.

For instance, companies leveraging digital platforms for supplier relationship management have reported response times from suppliers that are up to 35% faster and a 20% increase in supplier collaboration, illustrating the tangible benefits of integrating technology into vendor management.

Furthermore, establishing key performance indicators (KPIs) ensures that vendors adhere to contractual obligations and consistently deliver value. By adopting these systems, suppliers not only streamline their processes but also nurture a partnership mentality that fosters mutual growth and success.

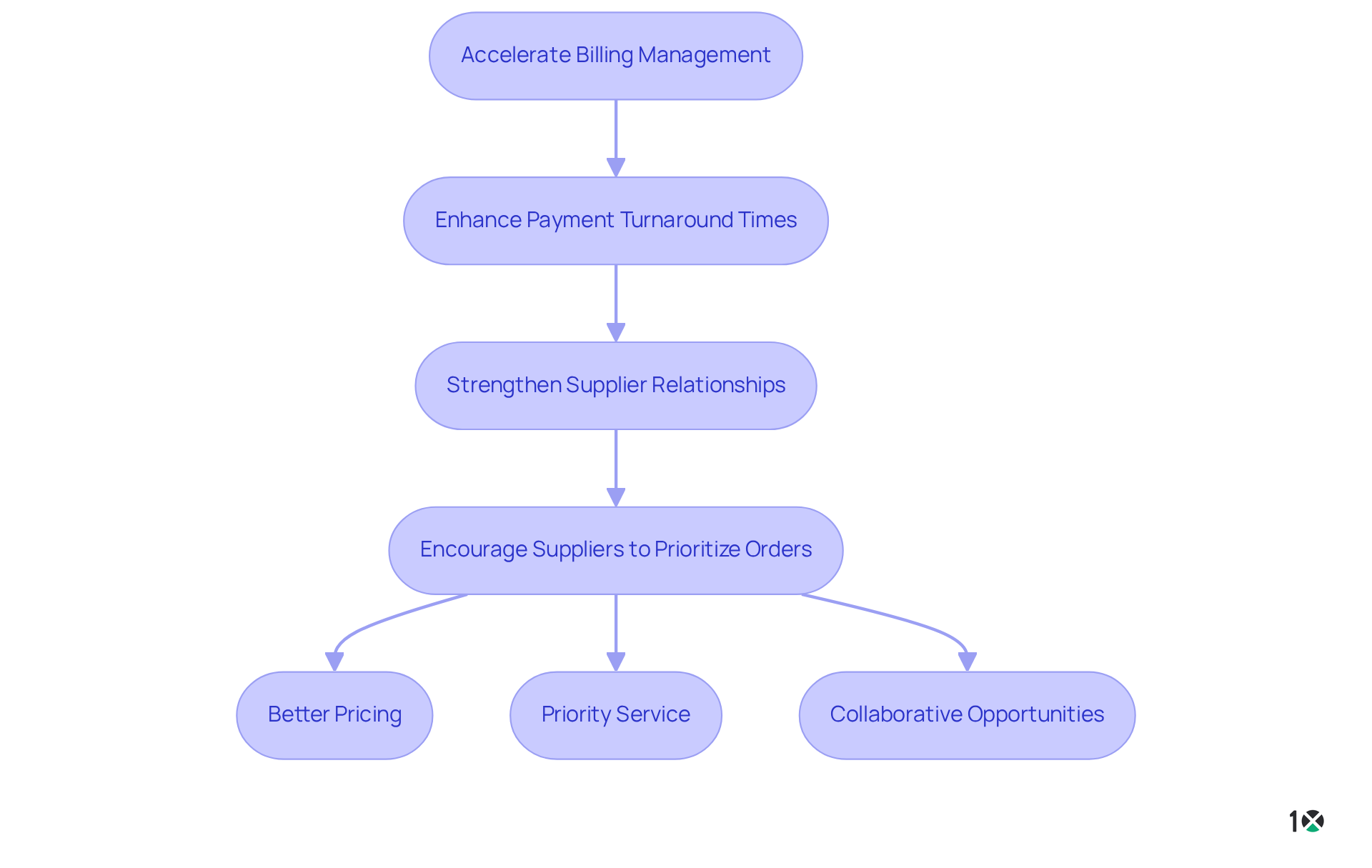

Accelerated Turnaround: Improve Supplier Relationships with Faster Processing

Accelerating billing management significantly enhances payment turnaround times, which directly strengthens relationships with suppliers. By ensuring timely payments, vendors foster goodwill, encouraging suppliers to prioritize their orders. This improved relationship often leads to better pricing, priority service, and collaborative opportunities for future projects.

For instance, a freight roll company that implemented automated invoice processing reduced its payment cycle from over 24 hours to mere minutes, resulting in increased supplier trust and collaboration. Expert insights reveal that timely payments not only avert late fees but also cultivate a more cooperative atmosphere, enabling distributors to negotiate superior terms and boost overall operational efficiency.

In fact, automated invoice processing can decrease turnaround time by two-thirds or more, underscoring the efficiency achieved through automation. Considering that 55% of B2B sales in the U.S. are paid late, the necessity of timely payments is paramount. As Brianna Blaney notes, “AP automation and AI reduce expenses by 81%, accelerate times by 73%, and cut human errors by up to 40%.”

In a competitive landscape, the ability to utilize automated invoice processing for prompt bill handling is not just a convenience; it represents a strategic advantage that can transform supplier relationships and foster long-term success. Operations managers should evaluate their current billing practices for potential automated invoice processing to reap these benefits.

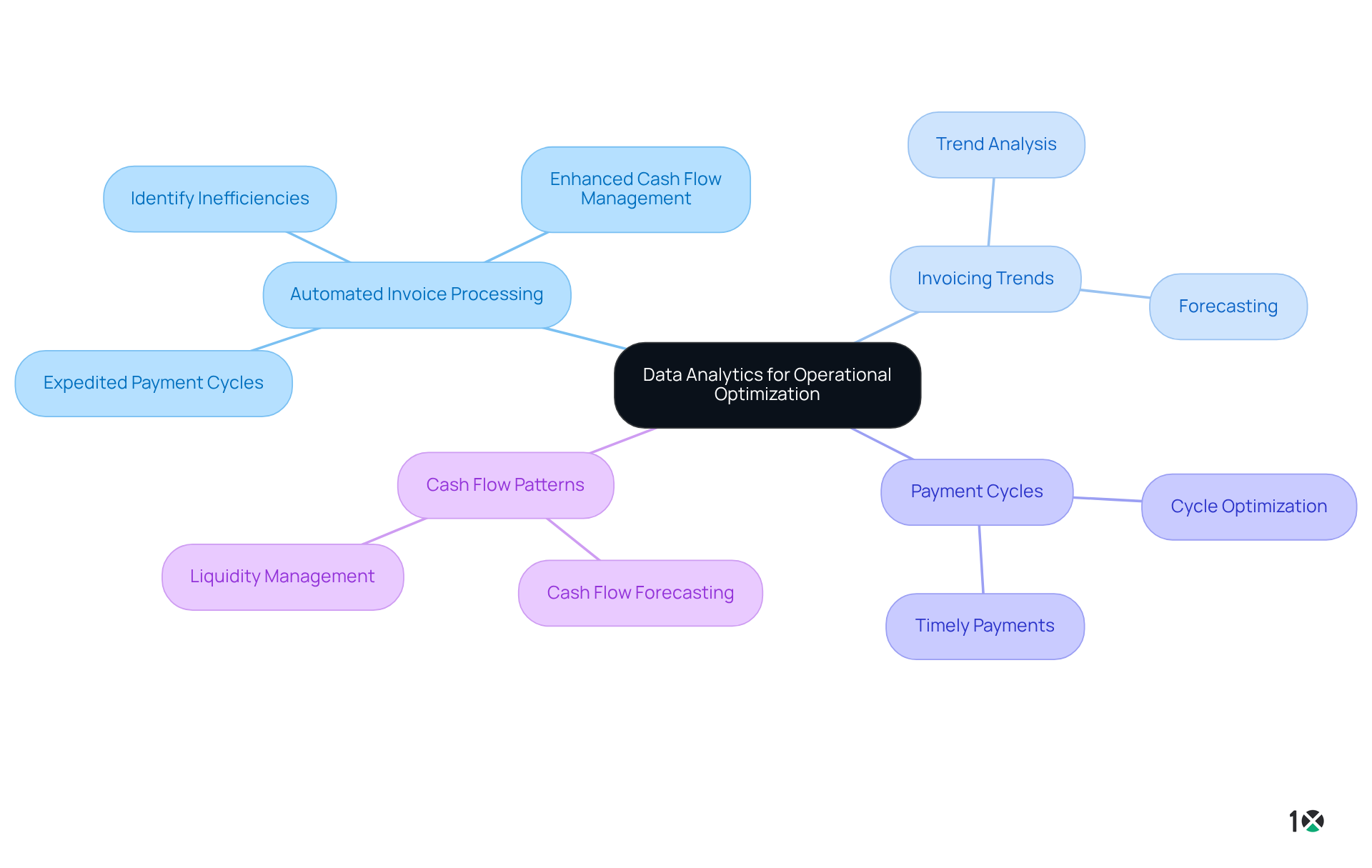

Data Analytics: Gain Insights to Optimize Operations

Automated invoice processing systems are equipped with advanced data analytics features that empower distributors to extract vital insights from their financial operations. By analyzing invoicing trends, payment cycles, and cash flow patterns, businesses can identify inefficiencies and areas primed for improvement.

Consider the staggering amount of data generated every two days—equivalent to 5 exabytes. Distributors can harness this information to make informed decisions that drive strategic enhancements and significantly elevate operational efficiency. Companies utilizing invoicing data insights through automated invoice processing have reported better cash flow management and reduced processing times, leading to a more agile economic operation.

As Jeffrey Hammerbacher aptly stated, “Data-driven decisions are better decisions,” highlighting the critical role of data analytics in financial operations. Furthermore, case studies reveal that organizations implementing these systems have achieved remarkable outcomes, including increased accuracy in invoicing and expedited payment cycles.

In an evolving data landscape, the ability to leverage these insights is essential for suppliers striving to remain competitive and responsive in a fast-paced market. To begin incorporating data analysis into your billing processes, consider adopting a robust automated invoice processing system that offers real-time insights and analytics.

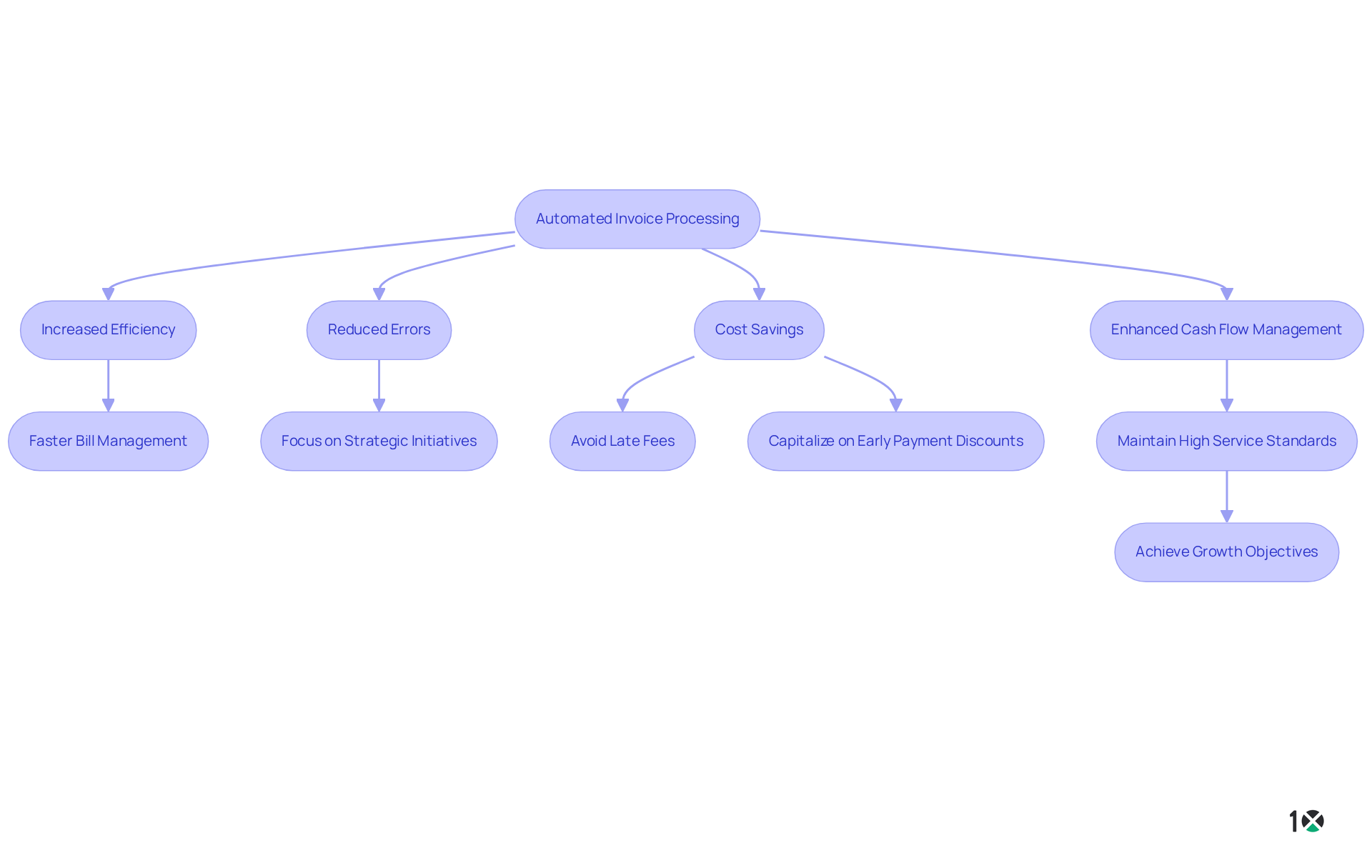

Scalability: Grow Your Business Without Increasing Headcount

Automated invoice processing empowers distributors to expand their operations without the need for additional personnel. As companies grow, they often face an increase in billing volume; however, automated invoice processing enables existing teams to efficiently manage this heightened workload. AI-driven systems can effortlessly handle larger quantities of bills as companies expand, making this scalability crucial for maintaining high service standards and accuracy—key elements for achieving growth objectives.

For instance, businesses that adopt automated invoice processing can handle bills more swiftly, as AI reduces the time required for bill management by automating repetitive tasks, thereby minimizing errors associated with manual data entry. Consequently, suppliers can focus on strategic initiatives that drive business growth, all while keeping operational costs in check. Furthermore, companies utilizing automated invoice processing report notable cost savings and enhanced cash flow management, enabling them to adapt to shifting demands without the need to hire additional staff.

This approach not only boosts productivity but also positions distributors to excel in a competitive market, ensuring they meet customer expectations effectively. By benefiting from timely and accurate payments, businesses can avoid late fees and capitalize on early payment discounts, further enhancing their operational efficiency.

Conclusion

Automated invoice processing offers a transformative opportunity for distributors, enhancing operational efficiency, reducing costs, and improving supplier relationships. By leveraging technology, businesses can streamline their invoicing workflows, resulting in faster payment cycles, minimized errors, and better financial visibility. This shift not only supports sustained growth but also positions companies to navigate the complexities of modern distribution with agility and precision.

Several key advantages of automated invoice processing stand out:

- Real-time data access empowers distributors to make informed decisions quickly.

- Significant time savings facilitate improved cash flow management.

- Reduction of operational costs through decreased reliance on manual processes.

- Enhanced accuracy in invoicing underscores the importance of automation.

- Ability to scale operations without increasing headcount enables businesses to grow sustainably while maintaining high service standards.

Embracing automated invoice processing is not merely a trend; it is a strategic imperative for distributors looking to thrive in a competitive marketplace. The integration of advanced technologies into invoicing processes can lead to substantial operational benefits, ultimately enhancing profitability and fostering stronger supplier relationships. Distributors should evaluate their current practices and consider adopting automated systems to unlock these advantages and secure their position for future success.

Frequently Asked Questions

What is 10X ERP and how does it enhance invoice management?

10X ERP utilizes real-time data processing to improve the creation, monitoring, and administration of billing statements. This enables suppliers to access current transaction details instantly, reducing the time spent on manual data entry and reconciliation.

What are the benefits of automated invoice processing?

Automated invoice processing significantly reduces operational costs by minimizing manual processes and errors. It allows businesses to reallocate resources to core activities, simplifies approvals, and enhances financial visibility, ultimately maximizing profitability and fostering sustainable growth.

How does automation affect cash flow management?

Automation accelerates cash flow management by generating bills immediately after order completion, reducing the time between service delivery and payment collection. This leads to improved cash flow and strengthened relationships with suppliers and customers.

What improvements can be expected in bill handling time with automation?

Automated invoice processing can reduce bill handling time from 15 days to just 1.5 days, representing a 10× improvement and can decrease turnaround time by up to 80%.

What cost savings are associated with automated invoice processing?

Businesses implementing automated invoice processing can see operational cost reductions of up to 50%. The average expense for manual tasks can be as high as $16 per document, while automation reduces this cost to about $3.

What productivity increases can businesses expect from adopting automation?

Organizations that adopt automation report an average productivity increase of 33% and a 42% decrease in costs associated with manual invoice processing.

How does real-time data integration impact decision-making for businesses?

The integration of real-time data streamlines billing tracking and facilitates quicker decision-making, allowing sellers to respond swiftly to financial fluctuations and maintain strong supplier relationships.